Amid other radical changes to daily life, it’s little wonder that Covid-19 spurred a drop in traffic congestion. Between lockdowns, business closures, and a shift to remote work for many, congestion metrics like Vehicle Miles Traveled (VMT) and Vehicle Hours of Delay (VHD) fell significantly. And nowhere was this shift more apparent than in once bustling downtown business districts.

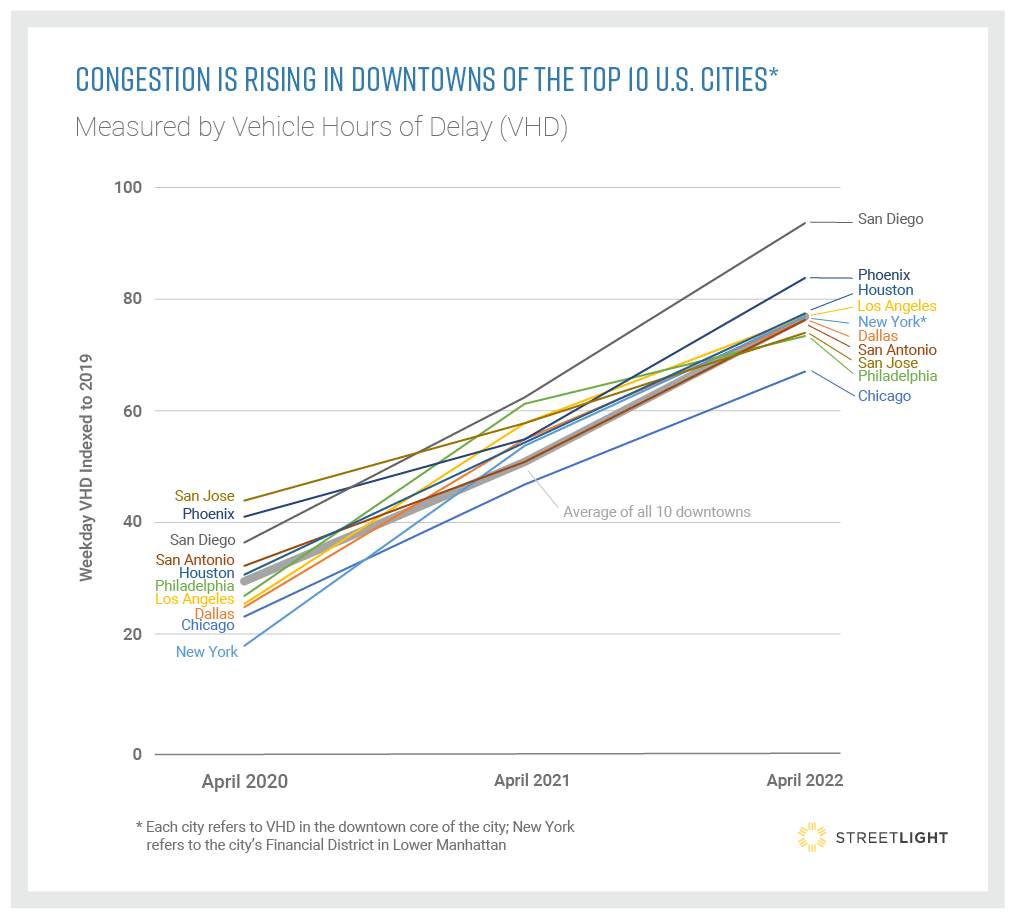

But now, over three years since the first lockdowns of Covid, VMT and VHD are rising in downtowns of the top US cities.

Meanwhile, outside of downtowns, VMT has already surpassed pre-pandemic levels, according to StreetLight’s analysis.

In an upcoming roundtable, StreetLight will team up with transportation experts from New York City, Houston, and other US cities to dive further into the data that show rising congestion in urban cores and what planners can do to ensure downtowns thrive.

After all, returning downtown traffic may signal good news for the economy, but it’s bad news for overall emissions and quality of life as traffic congestion makes a comeback across America. In the time remaining before congestion returns in full force, we still have an opportunity to revitalize economic activity in downtowns and beyond while avoiding the pitfalls of too many cars and the congestion that comes with them.

In order for city planners to encourage economic growth while addressing rising congestion, it’s important to first understand the lasting impact of Covid on downtown traffic patterns.

The shift in peak downtown travel hours

Many workers who once commuted into downtown for nine-to-five jobs are still working remotely, even as pandemic restrictions have been largely lifted across the U.S. Those who are coming back to the office seem to be doing so later in the day and staying fewer hours than the historic nine-to-five, according to analyses by StreetLight.

As a result, StreetLight found that congestion trends are amplified when broken out by day part:

● San Diego stands out especially when looking at day part trends. Midday and peak p.m. hours are nearly at parity with pre-Covid congestion.

● Los Angeles is also close to parity with pre-Covid congestion in the midday hours, but a.m. and p.m. are still down significantly.

● Bucking the trend elsewhere, Houston is still seeing depressed VHD in the morning and midday, but its peak p.m. VHD is only 13% below where VHD stood in 2019.

Still, StreetLight finds that VHD in the top 10 US downtowns is approximately 40% below April 2019 levels on average during peak a.m. hours, but only 22% lower during midday hours.

In other words, traffic builds later than it used to and is coming back faster during the non-peak hours.

The commute distance factor

The distribution of visitors traveling into downtown has also shifted, according to StreetLight analyses of the Financial Districts in Lower Manhattan and Downtown Houston.

Both of these areas are dominated by offices and analysts expected Covid-initiated work-from-home norms to impact traffic accordingly. Across the board, a.m. traffic heading into both areas has decreased since pre-Covid, but the analysis also revealed that long commute distances were more of a deterrent to downtown travel than before the pandemic.

In Manhattan’s Financial District, trips originating more than 50 miles away are down a whopping 40% since pre-pandemic, but even trips from other New York City neighborhoods less than 10 miles from Manhattan (where most commuters reside) are down approximately 30%.

Houston’s numbers are less pronounced, with trips from more than 50 miles away down by approximately 25% and trips from less than 10 miles away down 17%.

There seems to be a clear trade-off happening: for those with more manageable distances to travel, the pull of downtown is strongest. But for those coming from much farther away, downtown office culture holds the least sway.

Although housing density and urban sprawl differ considerably between these two major cities, the data consistently show a drop in peak a.m. traffic volume, which suggests not only that fewer people are commuting to offices downtown, but also signals that these downtown attractions are seeing fewer visitors, causing economic centers to suffer.

Data-informed strategies to help downtowns thrive

The takeaway is clear: if cities want to spark economic activity, they will need to think beyond nine-to-five culture.

Mitigating the congestion that historically kept some out of the city must play a part in revitalizing these downtowns and making them more attractive to recreational visitors and residents seeking to be in the city not for the nearness of work but for the quality of life.

A data-informed approach is essential for identifying strategies that will mitigate congestion. Luckily, many cities’ Covid-era experiments with slow streets, widened sidewalks, and temporary bike lanes, among other projects, provide a unique opportunity to measure such experiments’ impact on things like congestion.

Leaning into downtown destinations as cultural capitals also shows significant promise. For example, while the number of workers in offices is still below pre-Covid levels, the percentage attending popular entertainment such as NBA games or making restaurant reservations is now nearing parity with pre-Covid behaviour.

To learn more, check out the upcoming roundtable by StreetLight, where planning experts from major US cities including New York City and Houston will further explore Downtown Congestion Solutions. Registration is open to all for the live viewing on 29 September.

Click here to register.

Content produced in association with StreetLight