With all the debates over the most suitable future technology or technologies for charging and tolling, is it not time for the industry to look at what the rest of ITS is doing and bring a rank outsider - the smart phone - closer into the fold? By Jack Opiola, D'Artagnan Consulting LLC

Global Smart phone and Tablet App shipments in the US$

With all the debates over the most suitable future technology or technologies for charging and tolling, is it not time for the industry to look at what the rest of ITS is doing and bring a rank outsider - the smart phone - closer into the fold? By Jack Opiola, D'Artagnan Consulting LLC

It seems hard to believe that before theIn part the growth of the app market is attributable to technological advances such as the sensors to be found in smart phones. Developers have exploited these improvements and so many new apps take advantage of a phone's in-built GPS, compass, gyroscope and camera to deliver more succinct and culled information. For the transport industry, this has had both direct and indirect effects.

App-tastic

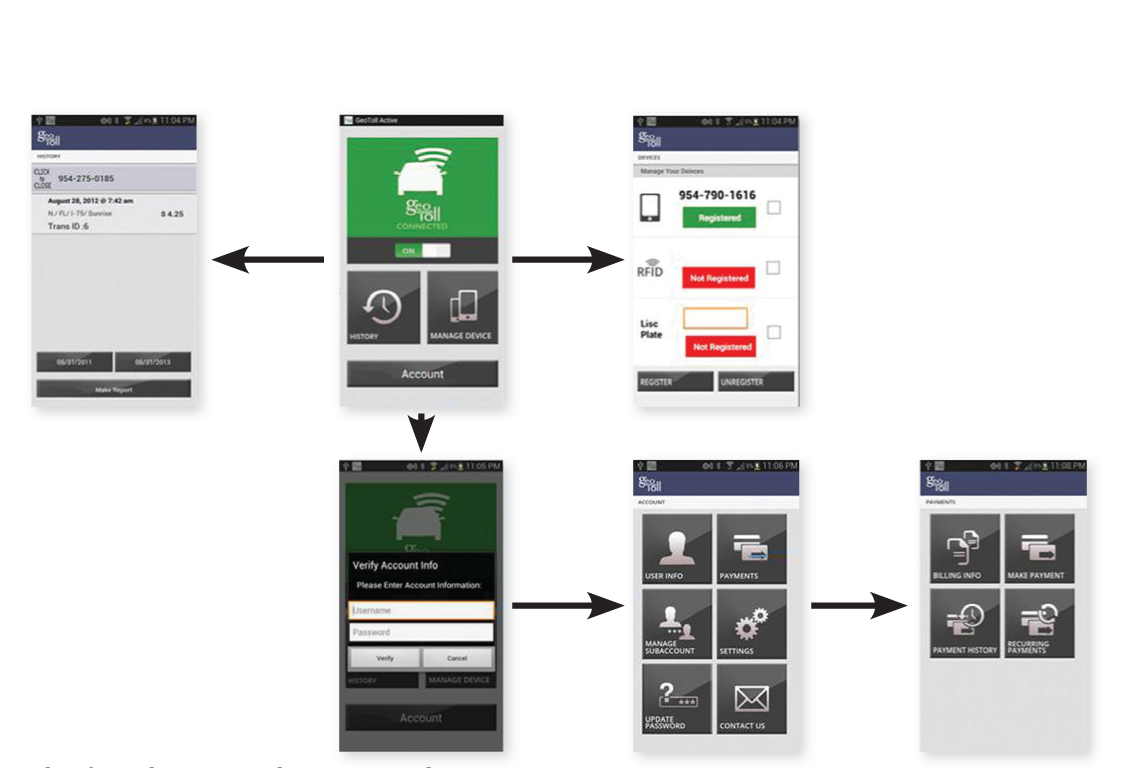

There are apps for traveller information, for example finding the nearest parking spaces, the provider of the lowest-cost fuel in a local area, the current bus schedule, personal and vehicle navigation, current road works and traffic flows. Layering on top of these are apps which connect us and our travel to our everyday lives, such as locating the closest Starbucks, making reservations at our favourite restaurants, pre-ordering our lunch-time sandwiches or even paying for that quad-shot, skimmed-milk, grande cappuccino.The European developments relating to Near Field Communications (NFC)-enabled smart phones and now also the US-based ISIS Joint Venture of AT&T, Verizon and T-Mobile provide a reliable means with which to pay for services directly. Smart phones are turning out to be the centres of our daily lives... except when paying tolls and for transit. Sadly, it would appear that the new eco-system of smart phones has left the toll and transit industries behind. These two industries may turn into some kind of forgotten world, complete with dinosaur systems, antiquated payment mechanisms and volcanic eruptions from dissatisfied customers.

A living museum?

Or will they? The toll industry has certainly moved forward since the late 1980s. We now have electronic toll collection for private cars, pre-pass truck clearance and, in a growing number of countries, time/distance/place-based charging for heavy commercial vehicles. The transit industry has likewise invested and proven the use of contactless smart cards in major projects in Hong Kong, London, Toronto and other cities besides. Yet these closed and proprietary revenue collection systems seem to take little account of the eco-system of the smart phone and the open system architecture model. Indeed, it looks as though the market potential demonstrated by the smart phone and app developers who are making the lives of their customers simpler, easier and less stressful simply fails to register.In one recent industry periodical, several industry experts panned the idea of using a cell phone for paying tolls. In fairness, the better question to have asked may have been whether smart phones could pay a toll or charge but three of the four experts cited dismissed the idea and obfuscated over the issues associated with cellular tower accuracy, the need for pinpoint precision, and the one-to-one, fixed relationship required to overcome the deficiencies of smart phones for revenue collection and enforcement.

In truth although the arguments presented appear to cloud the key issues surrounding the use of smart phones for toll collection, the smart phone's internal GPS, solid-state gyro, cellular triangulation techniques, built-in camera, dual-mode processors, memory and operating system make it an ideal platform for collecting tolls. Furthermore, the new addition of the current/future generation of NFC provides the means to interoperate across multiple toll domains.

The use of the current breed of smart phone's inherent features provides the clear and easy programming means by which to identify and separate toll roads from general-purpose roads. While the accuracy may not provide the pinpoint localisation necessary for ITS applications such as HOT or Managed lanes, the GIS coding for the entry and exit ramps for toll roads is sufficiently robust to determine a toll road trip has occurred. The continued reading of geo-coordinates also provides a further means by which to distinguish a trip on a toll road from one on a parallel service road which is charge-free. Location and discrimination of a toll road from free road has in fact been proven with GPS since the 1998-1999 Hong Kong ERP Field Trials and in subsequent GPS systems in Germany and Slovenia. The exact lane issue or correlation is not an access and tolling issue, it is an enforcement issue.

Dealing with enforcement

Judicial use of geo-coding can also provide 'enforcement' zones where digital cameras are prepared for the vehicle crossing their narrow read zone and providing an enforcement message via the smart phone's multiple communication links. The enforcement message can contain vehicle identification information, such as its license/registration plate number, which can be pre-entered into the application along with a video image of the actual license plate taken by the driver using the digital camera organic to today's smart phones. In fact, the driver can take a superior image of his or her license plate by simply placing the plate image in the left, right and bottom field of focus guides provided by the relevant application. Further to the point raised about one-to-one vehicle-to-driver or -account requirements issued by many toll agencies, the real world typically eschews this concept. Rental cars, borrowed cars, or temporary loaners used by owners while their own vehicles are being serviced all deviate from this rule. With the smart phone application for tolling, such an event is a simple image capture and alternative field input to send the correct vehicle data for the trip.Payment for the toll is also a simple matter. Smart phones have had several apps that allow the individual's credit cards to be embedded and used for the payment of services for some time now. These apps have also included the new Starbucks debit card application where the unique Starbucks ID is embedded in the phone and the funds are debited dynamically from the user's account. The refresh of the account can take place at any qualified Starbucks store or register, providing a wide network of stations at which to top up one's account. But adding NFC to the smart phone eco-system realises an entirely new dimension. In effect, NFC payments would be direct payments through the mobile network operator and the user's account. The user's account is backed up by his or her monthly payment, credit or debit card or direct bank debit account. Therefore, the smart phone toll payment can be direct and the toll authority has a guaranteed revenue source without the risk of non-payment.

In another recent periodical, the latest tolling technologies were compared. The cost of the typical hard-cased toll transponder was cited at or about $20, the older 18000-6B (proprietary) sticker tags were $10 and the newer technology 18000-6C tags were estimated at $2-$3 per sticker tag. A marked movement in the US toll market has been the excitement of the new lower-cost 6C tags; one major toll authority director was quoted as stating, "I can buy six 6C tags for the price of my current hard-case tags."

The capital cost implications are obvious. Possibly the same argument should be applied to using a smart phone for tolling. The sums are a bit awkward, because the cost to do so in capital cost terms is infinite. The customer or driver has already paid for the smart phone. Therefore the capital cost to the authority is nothing. This is a staggering saving even against the new 6C tags. The capital cost saving is only part of the story. The O&M costs also indicate huge savings in inventory control, management and maintenance liabilities; but the savings continue when considering the CRM, account management and guarantees for payment. Perhaps the industry should stop and think that, "There is an app for that..."