Thomas Hallauer from Ptolemus believes trials of connected road charging services will show the pay per mile concept will go much further than previously thought.

Drivers are progressively becoming directly connected to the transport infrastructure and while the methods are changing, the innovation is really in the models rather than the technology.

Satelise simplifies the process as it uses a tracking app that can be downloaded onto a mobile phone - similar to the ones found in the Usage-Based Insurance (UBI) industry.

As the Spanish toll industry goes through one of its most difficult hours, operators are bound to look at any element of friction that could slow or inhibit drivers’ use of the toll network. Mobile tolling serves many purposes in that context as it eases the registration process, especially for occasional users who frown at the necessity to rent an On-Board Unit (OBU). It also creates a closer relationship between the operator and drivers - Cintra can use the direct communication to create and manage rewards, discounts and associated services.

Such capabilities and services position the operator as a future mobility provider with an app that can be used for other transport modes in the future.

Maybe mobile tolling is too much too soon, but for operators like Cintra it is about preparing for the future of road charging and mobility pricing. Antonio García Fernández, Cintra’s head of technology and innovation says: “gantries will not be physical for very long and the future of mobility pricing cannot work with an OBU.”

The models are multiplying, and partnerships also, covering parking, car sharing, congestion avoidance, pay as you drive insurance …. Indeed much of the ITS world is becoming smartphone-centric and every actor in the chain wants to be the payment platform provider.

In the meantime, mobile tolling will be a way to save on infrastructure cost, bring flexibility in the day-to-day operations such as category change or variation in the pricing system and (of course) be a way to extend the charged network.

In practice

Evidently it will be most advantageous where there is no existing infrastructure or a free flow toll model. Satelise would geolocate the driver and levy the toll or road charge whenever a virtual gantry is crossed. The app’s role is simply to send position information to the server and to act as the customer interface.At the backend, the server calculates the toll price, including adapting pricing to various conditions and vehicle categories, and manages the transaction. It also places the virtual gantry where needed, which may not be where the physical ones are currently located.

A general rule is that one in three toll gantries are fully equipped for enforcement. Since the primary enforcement uses the location of the vehicle itself, far fewer gantries will be needed. As a driver can register several vehicles, the existing vehicle classification systems will need to be retained and matched to the mobile tolling account.

Cintra has also planned a mobile enforcement unit. Using a match between the number plate and the known location of the vehicle, the system can easily identify the ‘app customers’ and GPS location is used to differentiate and recognise a driver using the app to pay.

However, since Satelise will first be used on networks equipped with physical barriers, it has to work with existing plaza. To do that, the network will need to modify one of its ETC lanes to support video tolling.

In order for the barrier to open when needed, the app will send the number plate to the gantry 10 minutes before the car approaches the plaza. With the number plate in memory, the matching vehicle location and an extra camera installed to ensure the number plate is read, Cintra believes the mobile tolling transaction will be as quick as or quicker than the normal ETC.

To avoid the need for any phone manipulation while driving, the driver will need to start the app at the beginning of the trip.Privacy concerns will be an immediate issue with regulations in different countries forbidding the transfer of live GPS data and/or speed, so the architecture of the system might have to change if the system is to be used outside of Spain. Thankfully, managing ‘over the air’ updates of map or price data on iOS or Android smartphones is much simpler than on dedicated devices.

The real question here is not whether Satelise will work or not, rather why have the operators waited for so long? In all other branches of the connected vehicle market, the smartphone is increasingly becoming the platform of choice. And with the rapid progress in power management, user interfaces and sensors, it will only become more prevalent.

One answer could be that mobility pricing will require the app to run in the background and detect the mode of transport as well as the charge due.

Yet, a smartphone-only solution has its drawbacks: it is impossible to know which car is being driven; it is difficult to detect the mode of transport; background apps drain the phone’s battery; and it does not not support vehicle-centric services.

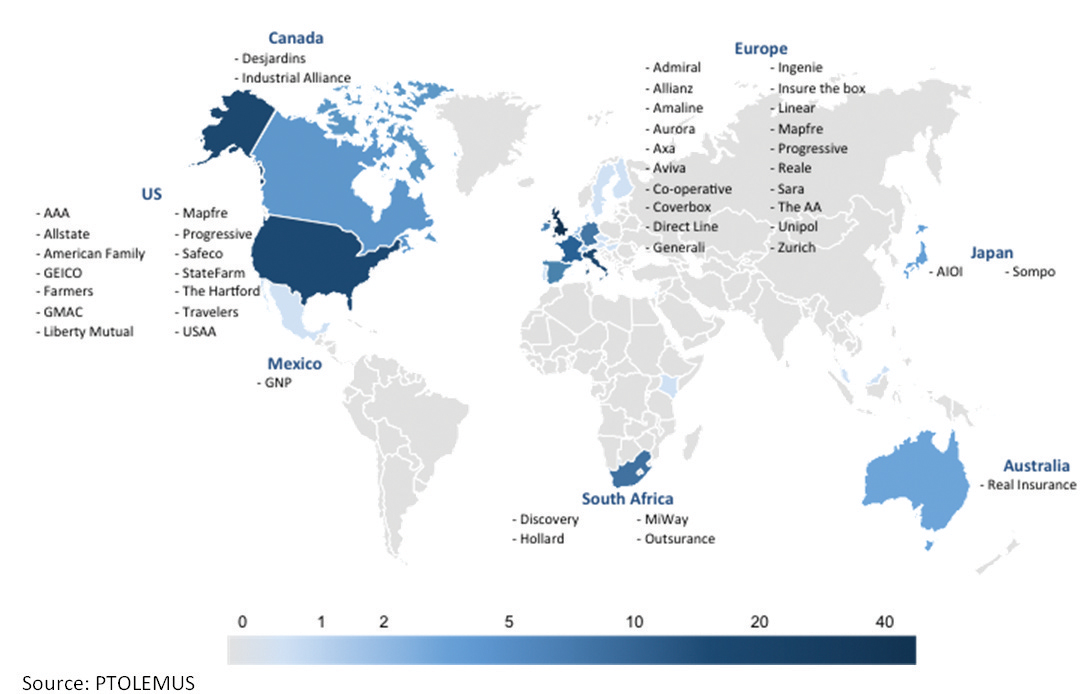

At Ptolemus we believe the tolling industry should seriously look at the Pay As You Drive insurance sector. Tracking and charging for insurance by the distance driven has been in play for more than five years during which time the devices, the service provision and the models have evolved extremely rapidly. While Cintra has reinvented the wheel with its in-house app, other operators should consider what is already on the shelves: they will save on development cost as well as deployment and testing time.

Deeper integration

A programme in Holland is testing a new service platform that creates a deeper integration of road charging into connected services.BNV Mobility is a consortium formed by road and toll service operators

Their latest project is MyJINI, a full-scale mobility service package funded through business partnerships rather than local authorities. Its purpose is to create a sustainable business model to support effective rush hour traffic ‘avoidances’. The key difference here is that the reward model is not fed by subsidies but through private partnerships with other businesses.

To demonstrate peak-period avoidance, past projects have used a number of different solutions including automatic number plate recognition (ANPR), smartphone and ‘black boxes’. This latest project uses a dongle which connects to the vehicle via the onboard diagnostics (OBD) port. All members receive a free ‘myJINI connector’ that gives behaviour feedback from the driver’s personal online dashboard. By not driving in peak periods drivers can earn $JINI points which can be used towards discounts on car insurance or in a web shop.

Drivers also get a range of other benefits, including a 5% discount on their insurance premium through a partnership with Allsecur (part of

A partnership with Shell also means drivers get a MyJINI fuel card, entitling them to a 15 cents/litre discount and the whole package comes with Emergency assistance in case of a crash.

Of course, every time the car is used during rush hours, $ JINI points are deducted from the drivers account. For the drivers as well as for BNV Mobility, the benefits – and subsidies- are measured in the number of days participating vehicles are not driven during peak periods. Beyond short-term avoidance, the project’s real aim is mobility behaviour change.

What the project demonstrates is a model by which a set of connected services can be used to sustain a road charging programme. By adding a payment function into the above mix of services and integrating it into the reward scheme, Brisa and Egis could generate a customer-friendly GPS-based open road tolling programme.

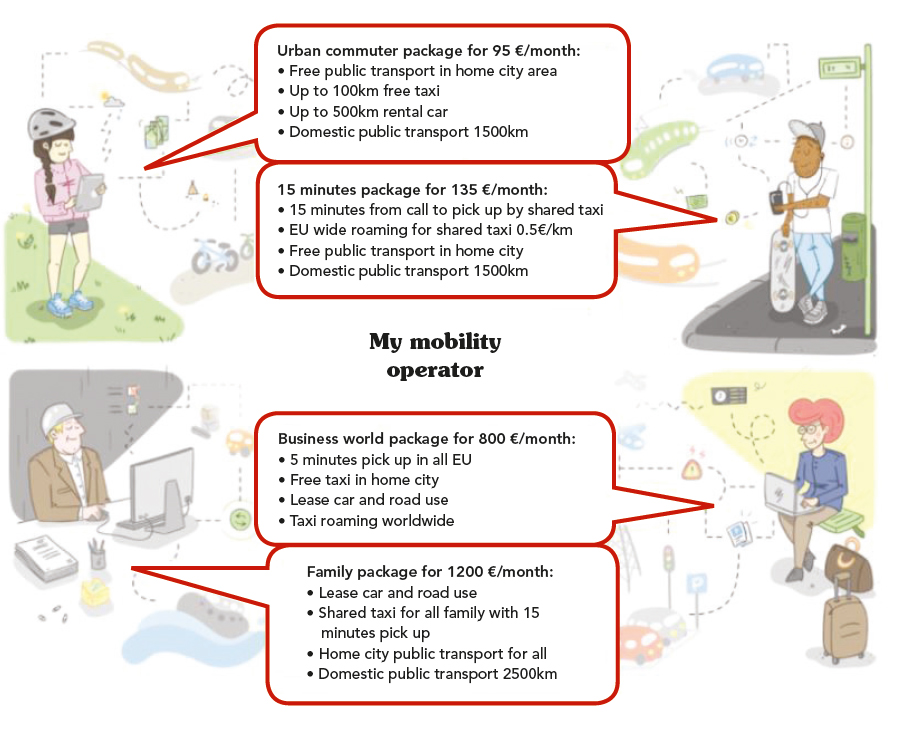

What these two programmes represent may not be tomorrow’s road charging systems but the individual steps the industry needs to take in order to become more efficient at financing transport infrastructure. The pay-per-mile concept will continue to grow and in the future we may pay for our cars in the same way as mobile phones; a monthly fee including financing, maintenance, warranty, remote diagnostics, insurance and road charging.

- About the author: Thomas Hallauer is research director at consulting group Ptolemus and lead author of the 2015 ETC Global Safety