David Crawford parallel parks with innovations in two continents.

Surveys of US cities indicate that drivers searching for parking can account for up to 37% of all urban traffic congestion. A 2011 study by IBM of 20 cities around the world found that nearly six out of ten drivers had abandoned their search for a parking space at least once; while motorists generally spent on average 20 minutes looking for a sought-after spot.

There is a growing consensus that the answer lies in the more effective use of available data to deliver better information. Giving arriving drivers what they need to know in good time will ease congestion and improve traffic flows for urban agencies and road operators.

Mark Prendergast, global product director, automotive with Seattle, US-headquartered traffic intelligence developer

Instead of relying on these, his company uses a combination of parking transaction data, results from its own real-time traffic probing, and mobile app technology that detects parking events to determine occupancy on a block-by-block basis. “We’re developing a proof of concept focused on San Francisco and are aiming to showcase it soon”, he said. This will chime in well with the city’s new congestion management strategy, launched in December 2014 to improve traffic flow and safety. It also follows on neatly from the recent publication of an evaluation of the San Francisco Municipal Transportation Agency’s (SFMTA’s)

Prendergast sees real prospects of operators using parking occupancy data and preferential real-time pricing to divert drivers away from busy zones to other, quieter ones.

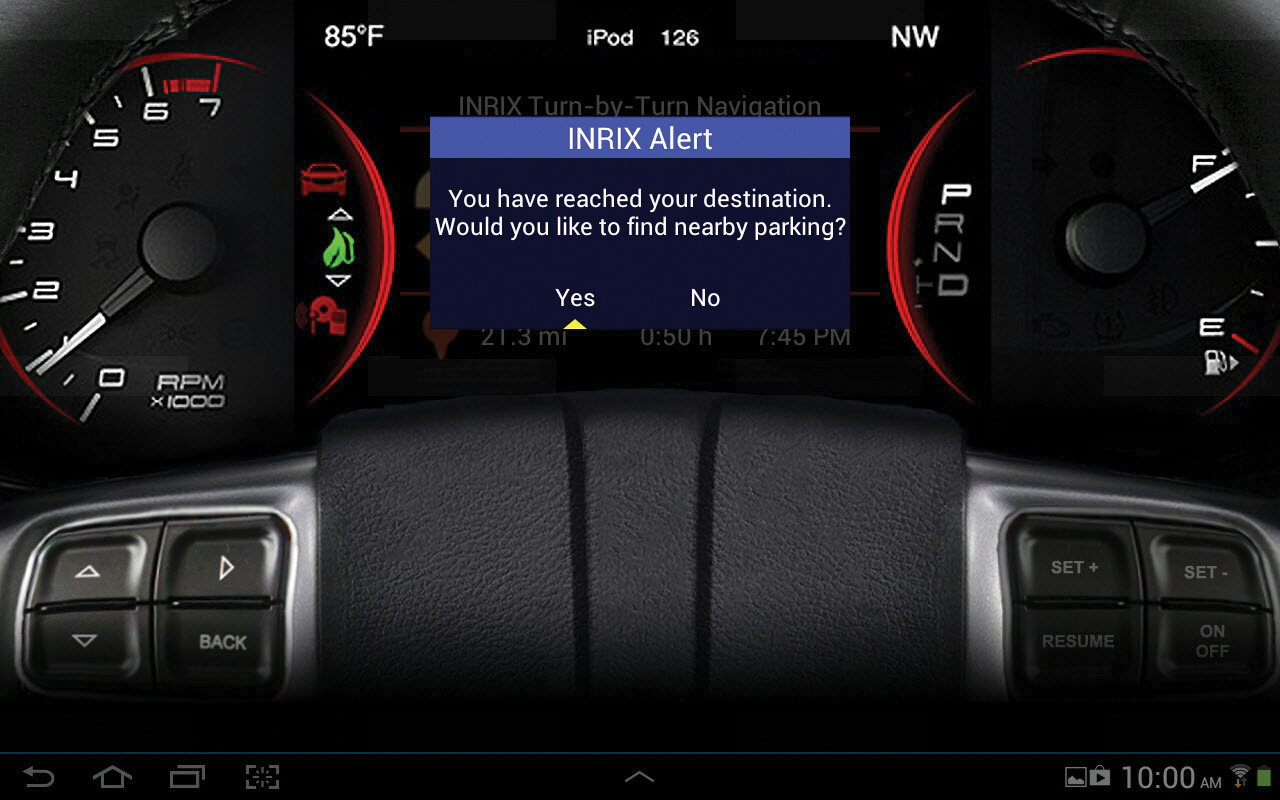

Off-street, the company’s current Inrix Park product is designed to provide costs and real-time information on locations and numbers of available spaces from a regularly updated database currently covering 55,000 locations in 41 countries in Europe. It enables drivers to interrogate nearby parking lots in a radius around their current position or intended destination.

The search radius is set by the car or equipment manufacturer, but typically ranges between 3km and 5km. Inrix supplies the data and works with automakers and OEMs to integrate this into their solutions.

Inrix Park has been in operation for well over a year in new Audi and Lexus cars, and vehicles equipped with advanced Kenwood navigation systems. The data is also available for users of compatible Samsung mobile devices, following the announcement of a new strategic partnership at the November 2014 Samsung Developer Conference in San Francisco.

In the same month, the company announced an expansion of its partnership with Volkswagen to install Inrix Park in new Passat models equipped with Discover Pro and Car-Net navigation sold in Europe. Other models will follow later this year.

Again in Europe, information management titan

The garages, each of some 300 cars capacity, are run by Vinci Park, which has operations in 14 countries. Richard Harris, Xerox director of communications and marketing, international transportation and government, told ITS International: “This is the first trial implementation of MAP-based parking anywhere in the world.

“If it’s successful, there will be a general roll-out across Vinci Park installations in the EU.” How did the opportunity come about?

The company held a ‘dreaming session’ (a technique it has developed to involve clients in unearthing ‘hidden needs’) at its European Research Centre Europe in Grenoble, France. “This was one of the innovations we featured; Vinci Park came and decided to test it.

“Neuilly-sur-Seine is an ideal trial site with four car parks lying close together, which makes a good fit for MAP. Vinci Park also operates the community’s on-street parking meters, and a second phase will be able to bring these in.”

The system is also designed to enable operators to assess the likely impacts on overall revenues of new tariffs before introducing them, using simulations based on historical data and patterns of user behaviour. This enhancement, currently under development and due for release in the second half of 2015, will take into account driver decision criteria including the proximity of alternative parking.

Tariff changes could typically involve the introduction of charging periods of less than one hour – such as 15 minutes as is due to be introduced in France in July 2015.

Vinci Park head of communications, Benjamin Voron told ITS International: “The tool provides very detailed reports that we can easily customise to give us a clear picture of all the information we need to monitor our business.” Other planned features include the potential to connect with external sources of data such as weather and traffic forecasts.

January 2014 saw Westminster City Council, in London, start the roll-out of the first phase of a new system supplied by

The council claims to be the first UK local authority to introduce the system across its entire road network. It has installed infrared sensors at 3,000 roadside spaces (including all its disabled bays) to detect availability and communicate the results to prowling drivers.

Australia-headquartered company Smart Parking’s system enables drivers using Westminster’s own ParkRight app, devised specifically for it by

A spokeswoman told ITS International: “Having our own app gives us the control and flexibility to develop it continuously in line with incoming innovations and customer feedback.”

The roll-out follows a successful pilot using 189 sensors in selected key locations. If all goes well, after a review due in March 2015, there will be a second-phase bringing in 7,000 more sensors.

Businesses can also use the app, or go to the authority’s parking website, to help them manage deliveries. The current version is available for iOS and Android devices on the Apple Store and Google Store.

Kieran Fitsall, the council’s parking service development manager, sees the project as a blueprint for every large city to manage its parking in future. The system uses Smart Parking’s low-height, anti-slip RFID-equipped SmartEye sensors to detect occupancy in real time, for repopulating drivers’ devices with minute-by-minute changes. It is currently operating in Australia, New Zealand, the Middle East, and South Africa, as well as in Europe.

SFPARK

The SFpark pilot set out make it easier to find parking in California’s most densely-populated large city, specifically by increasing the amount of time that on-street parking is available on each city block and improving the usage of parking garages. At its heart lay demand-responsive pricing, with the SFMTA periodically adjusting rates up or down in both types of location every two months or so.

The target was to achieve a minimum level of availability, to make it easy to find a space most of the time on every block, and ensure that garages always had some spaces. Meeting target availability also meant improving utilisation so that relatively few spaces—on-street or off—would lie unused.

The results showed that the amount of time that the city achieved its target parking occupancy levels (60% to 80%) increased by 31% in piloted areas, while the amount of time that blocks were too full decreased by 16%. In the process, the US federally-funded demonstration collected what the agency claims as an ‘unprecedented dataset’. The 2014 evaluation showed that demand-responsive pricing helped to improve parking management most dramatically when meters were used as space demand management tools, in which role they proved ‘extremely effective’.

The SFMTA is maintaining its policy of demand-responsive rate adjustments in the piloted areas, and developing plans for expanding the approach more widely. The prime contractor for the project was Serco, with data collection being the responsibility of Nelson\Nygaard Consulting Associates and Ewald & Wasserman Research Consultants.