New traffic data products and services have been launched to aid transport and urban planners and business with detailed intelligence on journey patterns, reports Jon Masters.

Manual travel surveys ought soon to become a thing of the past for transport planners and the business community. The technology now exists for getting sophisticated levels of traffic and trip data from connected vehicles. Cars and commercial fleets carrying a GPS device, or a mobile phone or smartphone are the sources of the information in their millions.

A growing global network of over 250 million connected vehicles is supporting what the traffic data specialist

“Over recent years, the use of connected car data has primarily been about sourcing data on real time traffic information for governments. But over this past year we have started populating the analytics more. The base data is the same, but we have differentiated to give information on trips and vehicle volumes,” says Inrix analytics product manager Justin Graham.

Bolt-on products

Inrix launched its new Insights platform at the beginning of May this year, with two bolt-on products: Inrix Insights Trips; and Insights Volume. The first gives origin-destination data and Inrix describes it as a ‘data as a service’ application for understanding population movement across metropolitan areas and between defined points. The second is claimed to be the first service to provide traffic counts for specific locations and times of day or days of the week using connected vehicle data.

“These new products focus on different areas on top of the base level analytics. Insights Trips builds a picture of how people are using roads, giving greater understanding of traffic patterns across and between all areas of population.

The software can show how people are using road networks, and the alternative routes people are likely to take if roads are closed for maintenance or redevelopment,” Graham says.

The Insights Trips application opens up a lot of possibilities, Graham says, particularly in the realm of infrastructure development, its planning and design. Substantial quantities of travel and trip data these processes demand can now be generated automatically and significantly more quickly than conventional manual surveys.

“We think the Trips product will help highway authorities and agencies gain a lot more insight into travel behaviour and trip patterns,” says Graham.

“The Insights Volume application goes beyond what we’ve done before as well. Previously we’ve given traffic speed and travel times as the means for assessing or describing levels of congestion, but not how many vehicles are on the road at any one time.”

Wider applications

The Insights Trips source data is essentially the same as that used for Inrix’s normal traffic services – GPS positional information from connected devices, anonymised and aggregated for understanding trip patterns. For Insights Volumes the same data is augmented with anonymous carrier network data from phone providers.

“These products can provide useful origin-destination and traffic count information for road network operators, designers and planners. We also believe there are wider applications across advertising and marketing; and for business investment decisions, profiling travel behaviour and patterns for making better, more informed decisions,” Graham says.

“In the retail sector, determining the best location for shops or stores requires a lot of different data metrics on population and people movement. So understanding volumes of vehicles passing can help inform decisions on the best place to locate a business, particularly so if the data is aggregated to specific times of day, days of the week or where the trips are originating from.

“This sort of information can allow evaluation of the demographic of passing traffic, so the most appropriate type of retail outlet for a particular location, and by showing where potential customers come from it can indicate if one store is likely to be stealing custom from another.”

Inrix’s traffic volume data represents a significant improvement on conventional traffic counts, Graham says, because it can be finely tuned to times of day. Vehicle counts can be given every 15 minutes. “And we can split the data based on direction of flow, so giving a very good level of depth and detail,” he adds.

Claims tested

Academics at the Texas Transportation Institute (TTI) have evaluated Inrix’s Insights software as part of a wider study for the Texas Department of Transport (TxDOT). This work, which was carried out about a year ago, was done to provide an evaluation of both Inrix’s GPS-based Insights software and positional smartphone data in comparison to a benchmark of Bluetooth origin-destination information. TTI and TxDOT already had a network of Bluetooth tracking technology in place to set this baseline for comparison.“Part of the reason for doing this study was the great amount of marketing we were seeing for smartphone data, but we had concerns about its positional accuracy. So we have been putting a lot into comparing the different technologies,” says TTI research scientist and programme manager Ed Hard.

The TTI study was performed across the jurisdiction of the Tyler Area Metropolitan Planning Organisation in Smith County in Texas. Trips passing through the study zone – ‘external to external’ – were recorded using GPS, smartphone and Bluetooth data, and compared to a known Tyler area model, as were internal to external journeys and vice versa.

The results, says Hard, showed that at the time a combination of the different technologies was the best way forward at an urban metropolitan level.

“We felt that the Insights GPS data showed great promise. It cannot provide additional information, such as resident versus non-resident data, but it can give vehicle type, which cannot be obtained from smartphones,” Hard says.

“Overall, all of the different technologies have different pros and cons. GPS generally has smaller samples, but it’s improving and the GPS and Bluetooth data compared very well on key Interstates and arterial roads.

“An important point to observe is that how the data compares depends on the type of origin-destination study being done. For example, across a large area, smartphone accuracy is not such an issue. GPS data is coming into its own in smaller areas, especially so as its penetration builds. We are looking to do more studies and research into this particular subject, including a similar test across a larger area of Dallas Fort Worth early in 2016.”

Data pointing to parking availability

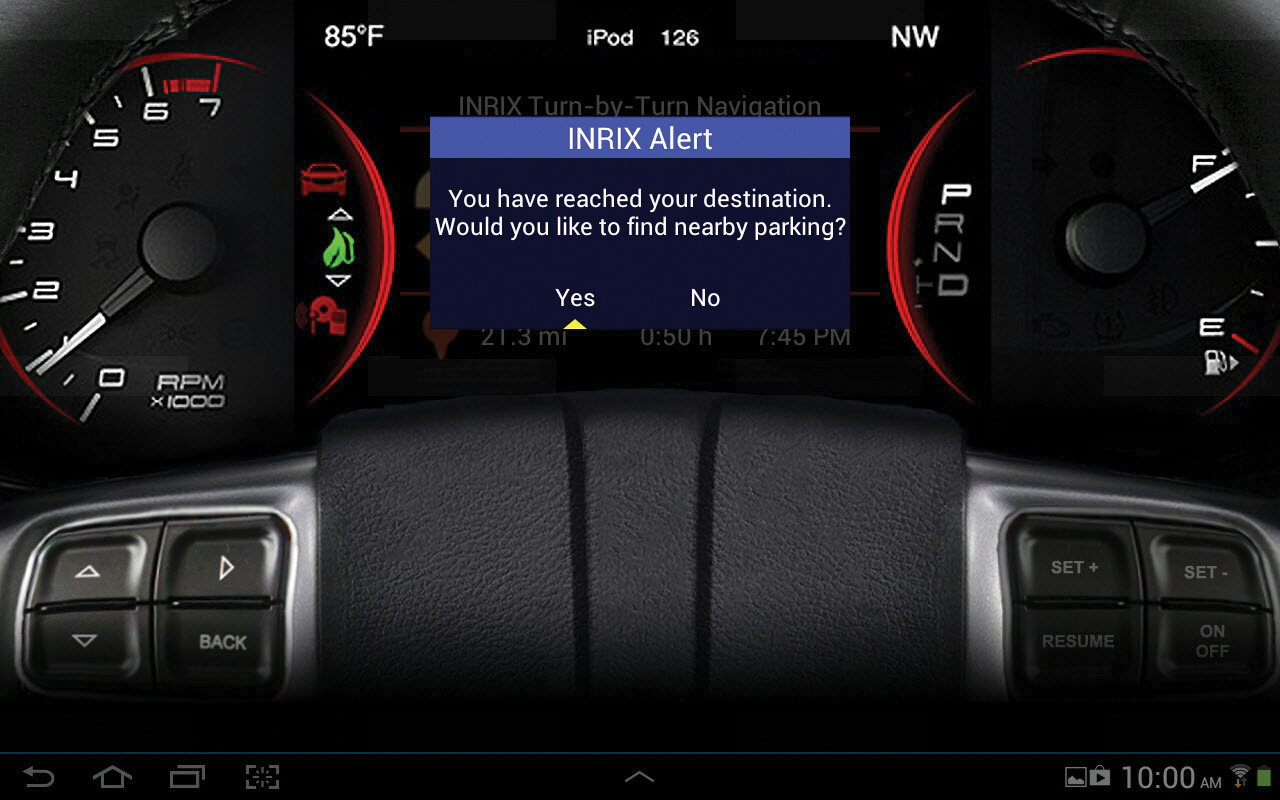

Inrix is launching further products and services off the back of its GPS data tracking and analysis software for showing availability of on-street parking. There are two strands to this: In-vehicle navigation systems can now indicate to drivers the likelihood of an area having parking spaces available, on a red, amber, green rating. BMW was announced at the beginning of June as the first vehicle manufacturer to include Inrix On-Street Parking in its ConnectedDrive cars.

Second, but not least, data on patterns of availability, demand and usage is being offered to aid highway and city authorities as they consider parking policy as a branch of traffic management.

“Research has found that in cities around a third of drivers at any one time are looking for a parking space. There is a great opportunity here for on-street parking services to reduce congestion, but first authorities have to understand how parking spaces are being used,” says Inrix director of marketing Jim Bak.

“From talking to cities we are finding many are carrying out manual surveys or taking data from smart meters, but this gives only a snapshot in time, whereas there is tremendous variability.

“There is data from sensors in spaces and from smart meters. Thirdly, predictive models can be built by correlating data on trips starting and ending on that street, factoring in traffic with parking availability. We’ve been testing this against sensor data and getting 80% accuracy,” Bak adds.

A number of cities, such as San Francisco, have demonstrated some success with parking management technology that adjusts pricing as demand varies. Systems based on sensors alone are proving problematic due to issues of maintenance, Bak says.

“Authorities may be considering if they can put in additional spaces or altering the location of parking to reduce congestion. Information matching traffic data to parking availability can aid urban planning and it helps drivers,” Bak says.

“Inrix On-Street Parking is a new offer for vehicle manufacturers and a service for authorities that can be built bespoke to what they want to know.”