Trafficware provides the tech to manage intersections all over the world. Colin Sowman asks CEO Jon Newhard about the ‘questions behind the questions’

Last year, Trafficware CEO Jon Newhard negotiated the company’s acquisition by Cubic Corporation and now serves as general manager of Trafficware within Cubic’s Transportation Systems business unit.

Specialising in traffic signalling solutions and advanced traffic management systems, Trafficware works with the authorities in many large cities looking to replace ageing and outdated technology. “We are working with one of the largest cities in the US to replace an old traffic management system (ATMS) and controller software,” he told

It became apparent that the previous vendor had not kept up with the Microsoft technology stack its system was built on - meaning that if anything broke, there was nobody to fix it. “What they really needed was ‘future-proof’ software where the technology stack will continue to be updated,” he explains. “So the software agencies purchased today becomes more valuable over time, rather than depreciates.”

According to Newhard, this problem has been resurfacing for the past five years and future-proofing is vital in order that the system will continue to work with new equipment that authorities purchase over the next decade or so.

Such shortcomings prompted Trafficware to introduce a policy of constantly refreshing its software and adding new features suggested by customers. Newhard also emphasised the need for backwards-compatibility - for all the new products to work with previous investments which agencies have made in Trafficware equipment. “We want customers to know that the investment they are making today will be good in 10 or 15 years from now - just as the investments from past decades can be leveraged today.”

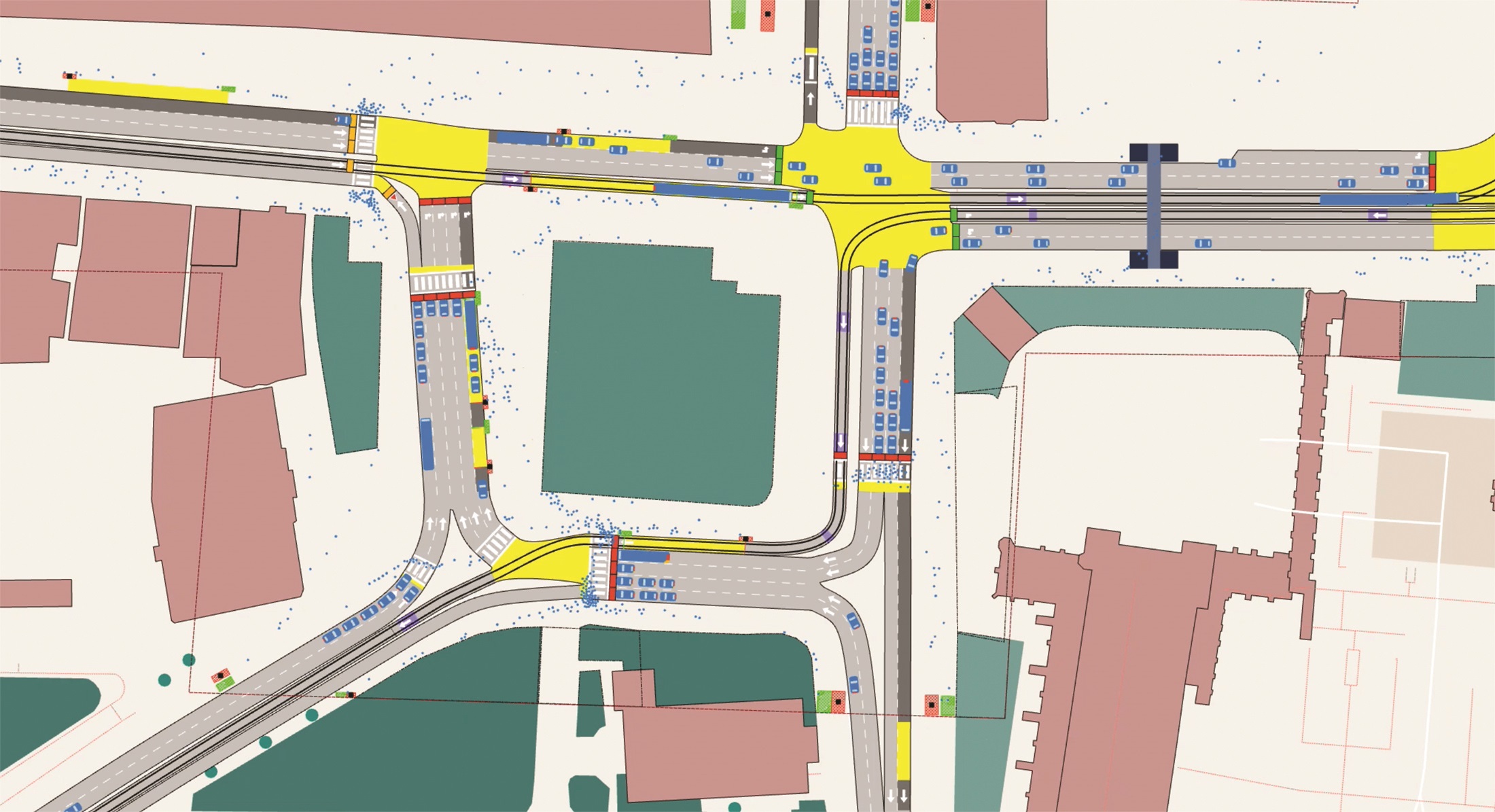

Software longevity is of little benefit if the overall system is not both efficient and effective in managing traffic and easy to use for the traffic control staff, he adds. For its part, Trafficware has integrated its Synchro and Sim Traffic platforms with its ATMS to remove the need for entering data twice into two different platforms, and to utilise real-world data to re-time corridors. Designed for web-based integration, Newhard says the system retains its simplicity and flexibility.

In his experience, identifying and supplying the best option for authorities is not always as straightforward as it might first appear: “It is simple to quote and deliver against a specification. But by spending time talking to authorities you get to understand what they actually want to achieve - and there can be new, different and more efficient ways to deliver that end result that are possibly less expensive or more robust or offer additional functionality. So it is vital to get their input and feedback to ensure that, as suppliers, we are really building solutions they need to make their lives better.”

It has supplied traffic control systems to almost all authorities in Silicon Valley and Las Vegas for the last decade; for instance, when

Perhaps more significantly, Trafficware worked with Audi, BMW and TTS on the first Vehicle to Infrastructure (V2I) pilots for the Computer Electronics Show in Las Vegas. That, and subsequent experiences led to it introducing a connected vehicle module in 2016. Through working with authorities that deployed the module it became evident that edge computing could improve functionality while also reducing latency and freeing up bandwidth.

“We then realised that we could utilise an AI [artificial intelligence] kernel to make our communication even more efficient and run predictive algorithms. That became our TidalWave unit which has enabled agencies to connect over 3,000 signals – and even more will be activated soon.”

But where does he see connected vehicle technology going from here? “This is a nascent technology right now but I think it is likely to be a ‘chicken and egg’ situation - automotive companies are not going to include Infrastructure to Everything (I2X) technologies in their products if the infrastructure isn’t available to handle them. So, the more smart infrastructure we build, the more demand there will be for smart technologies in vehicles and the more connected technology there is, the more that agencies will need smart infrastructure at intersections.”

Newhard believes Trafficware is currently the most prepared supplier to facilitate that move: “We have lit up 3,000-plus intersections, deployed in the cloud and on the edge, and we have done both cell and DSRC [dedicated short-range communications]. But I have no illusions that we will have to continue to innovate and be nimble in the way that we deploy these solutions and keep searching for the ‘questions behind the questions’ to build the right technology solutions that are also ‘future-proofed’.”

Asked about where the wider ITS sector is going, Newhard predicts a period of consolidation. “There are a handful of companies – including Trafficware - in this space that have invested in R&D over the last half a decade or so and authorities are gravitating towards these producers because they provide a better path forward. As a result, these companies are growing at 20-40% per annum while those that have not invested are either stagnating or in gentle decline.”

He says some authorities are buying from two or more vendors and trying to stitch a solution together themselves. While understanding the agency behaviour - a reaction to previous bespoke systems’ lack of connectivity and interoperability - he says: “The industry should not work this way – it’s not good for authorities to do this.”

Therefore, he sees value in bringing many of the innovative companies together, enabling proper integration and continuing to move the total solution forward at regular intervals. “It is clear to me that this would benefit agencies and there are ways to do this that also create value for shareholders.”

He also sees the need for consolidation to expand the industry’s scale in order to work with companies such as GM, Toyota,

Is that why Trafficware has become part of Cubic? “Partly,” he acknowledges. “We realised that while Trafficware has achieved high organic growth, we need to acquire other innovative companies in the ITS sector. Our previous financial partner had helped us fund all the software developers, traffic engineers, sales people, and manufacturing folks we hired over the last seven years - but they did not have the appetite for an acquisition spree.”

Cubic, for all its global reach and transit operation experience, “was missing technology to run the intersections… and we were looking for our next partner”, he adds. “Furthermore, we had also been told, largely by our international customers, about the importance of being able to handle multimodal traffic. An agency in Mexico was interested in our SynchroGreen adaptive controller but as we spoke they told me that 70% of their citizens rode the bus to work. SynchroGreen has a strong adaptive algorithm and separately we have a good transit service priority (TSP) solution, but if you think about what we should deliver, it would be something slightly different than what we have today.”

SynchroGreen has been deployed at about 1,000 intersections on three continents - but the algorithm treats all vehicles equally. “For an agency where 70% of the citizens take public transport to work, we may want to tweak the algorithm so it favours a bus with 37 people on board rather than a car with an average of 1.2 occupants,” he says.

The data needed to do this would have to come from a passenger information system – such as those provided by Cubic. “It was also supportive of our acquisition plans and has other assets we could leverage, a customer base we could sell into and the cultural fit was excellent as we both focus on customer success and innovation,” Newhard adds. “Mobility as a Service is also in play here. There should be an integrated customer experience across all available modes of transportation which should include a single payment covering the modes utilised. This is dead centre to Cubic’s capabilities.”

He sums up by saying: “We are in the process of digitising transportation assets across the world and that technology is the new asphalt.”