For the last century the transportation industry has been focused on the supply of infrastructure to support the ever growing fleet of vehicles and the greater number of miles covered by each vehicle. Our focus has been planning, funding, designing, building and maintaining roadways. Politicians, engineers, planners, financial managers … all of us have had this focus. We have experienced demand growth since the first model T was launched from the factory. Congestion in urban areas, safety and the economic need to move people and goods and to compete in a global economy has driven our thinking. The ability to supply infrastructure has been the measure of transportation performance.

Roadways and transit properties are public goods. They are generally built by government, maintained by government and funded by gasoline tax revenue, though tolling has grown in prominence because of the inadequacy of tax revenue to satisfy ever increasing demand. Transportation has been a public works effort administered by public agencies with a substantial institutional momentum that has kept the planning focus on supply. It is a highly regulated, standardised and lengthy process with enormous political, social and economic implications. In recent years, we have begun to use managed lanes in an attempt to meter demand and policy has been developed around the management of demand. In effect, the transportation community has begun to ‘operate’ infrastructure through price controls based on occupancy and congestion levels.

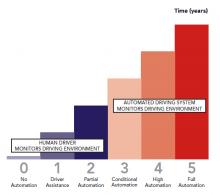

Autonomous vehicles

The development of autonomous vehicular travel will however modify the collective demand for transportation infrastructure in ways that have perhaps not been fully appreciated. The deployment of autonomous vehicle features will also occur as a result of competitive business agendas rather than a public policy formulation approach. Perhaps we have not fully considered the potential ramifications on existing transportation plans nor the rapidity with which it might occur. The combined effect on the need to develop additional transportation infrastructure will be cumulative as the percentage of vehicles with autonomous features increases and as the features on each vehicle increase.This is not the first time that changes in the vehicle fleet have effected transportation development. The increase in fleet fuel efficiency influenced the ability to fund transportation infrastructure over a period of several decades and yet there was surprise when development slowed as a result. The demand for infrastructure did not decrease just because vehicles could go further on less fuel, there was just less money to provide for the growth in demand and the accumulated deferral of maintenance.

Fuel efficient vehicles, electric vehicles and vehicles operated on propane, hydrogen and so forth all ‘demand’ highway capacity to operate. Autonomous vehicles, trip matching and other converging technologies could change transportation paradigms to an even greater extent.

In 1999 the annual meeting of

It was essentially the combination of adaptive cruise control, which maintained distances between vehicles and lane alignment maintained by sensors embedded in the pavement edges that communicated with the vehicle. While operating in a controlled environment, it was nevertheless an impressive demonstration. It was clear that vehicle autonomy would have many benefits, however the barriers to such technology were considerable. Potential litigation as a result of equipment failure was high on the list of barriers identified. The cost to equip the vehicle fleet with adaptive cruise control and roadways with necessary sensors was seen as enormously expensive and would likely take decades. The regulatory considerations seemed at first insurmountable and questions such as determining which roadways should allow autonomous vehicle operation, the human interface requirements and a myriad of other barriers led policymakers and the industry in general to consider the practical implementation of autonomous vehicles to be decades away and perhaps not possible at all.

What’s changed?

The private sector has continued to develop the facets and features of vehicle autonomy and began to deploy them as commercially available accessories. On a parallel but radically different track, fully autonomous vehicles were developed using visual and other sensors and advanced software. They are already being driven on public highways and streets in normal traffic where highly unpredictable humans (both drivers and other road users) create instantaneous and wildly varying circumstances.Simultaneously, trip matching using smartphone locator technology, online payment software and instantaneous driver/passenger communications began to be deployed.

As these technologies were refined business models were developed and vehicle manufacturers and software developers began to see the business potential of the convergence. Vehicle manufacturers have started to embrace autonomous travel and have set business strategies for introducing autonomous features for the automobile and competition has quickened. Drivers can now choose whether they want adaptive cruise control, lane alignment, crash avoidance or other features and as further deployment of these technologies occurs, the competition between manufacturers will increase. The deployment of autonomous vehicles is becoming more a factor of commercial competition and individual economic choice than that of policy development.

At the recent

The collaborative business potential of automotive companies, fully autonomous software and trip matching is difficult to predict but the convergence is clearly occurring.

While regulation may slow the process it seems unlikely to be a terminal problem; safety goals and economic competitiveness are too nationally significant. After all, other automotive features that have saved lives have been the result of regulation (air bags, seat belts, ABS…) and increased fuel efficiency has been partially a result of CAFÉ standards.

Infrastructure demands

The question is not when the fully autonomous vehicle will become a reality or not, but how the cumulative introduction of autonomous features and converging technologies will effect transportation plans and the requirement for transportation infrastructure.The difficulty in predicting the need for transportation infrastructure based on demand, at a given price, is the lack of a publicly understoodconnection between demand and price. As with many public services, it is difficult to relate the choice to use publicly-funded transportation with the cost.

This is especially true for transportation since so few consumers of the infrastructure have any idea what it costs to travel on a highway or use a transit service. The one exception is perhaps the tolled highway and perhaps, more tellingly, the resistance to tolling. Even in this environment, the greater the supply (interstates, highways…), the higher the demand.

So how might increasing vehicle autonomy affect the need for transportation infrastructure? It is likely that there will be more people in the average vehicle and that there will be additional vehicle capacity derived from the same transportation infrastructure.

The number of vehicles that can travel safely in a given lane will be impacted by the ability of advanced vehicle controls.

Currently the average safe driver leaves ‘one car length per 10 miles per hour’ between vehicles (at least they have been taught to do so) but the automated (and autonomous) systems can react much faster than humans and can therefore safely travel much closer together.

As a larger and larger percentage of the vehicle fleet becomes capable of safe travel in less space, the real capacity of the roadway increases. As the demand for highway infrastructure is predicated on the safe traveling distance under human control and traffic and revenue predictions are based on these assumptions, highway capacity manual assumptions will be increasingly inadequate as autonomous features are introduced. A more immediate consideration is whether and to what extent vehicles with adaptive cruise control should be allowed to intermingle with normal, that is human-controlled, vehicles. Should there be restrictions on how close a vehicle should be allowed to travel behind another and how does one know whether the vehicle behind is operated on adaptive cruise control or by an over-zealous human driver?

The average number of persons per vehicle may change as well. Several businesses have been established that offer driver and passenger matching for car and ride sharing.

There has been some institutional resistance as this challenges some long held business models but the convenience and economic benefit that can be derived is leading to growth in these services. Freedom from the responsibility or cost of driving and the opportunity for drivers to share or fully fund driving costs could result in more passengers in each vehicle. Single occupant vehicular travel has been a predominant and enduring pattern in transportation but as the convergence of technologies increases, this may at last begin to change. Even a small percentage increase in vehicle occupancy will have a significant effect on the demand for transportation infrastructure. This change will not be immediate, but it is likely

Tipping point

Individual choice of a mode of travel is based on convenience, safety, economics and freedom. The populace is sometimes slow to adopt new technologies but convenient, safe and economical travel is a large factor in the quality of life and as more people in the US become seniors, mobility becomes a major factor in their quality of life. The ability to drive is often synonymous with whether someone can maintain a home without assisted living services or even moving to a rest home. The autonomous vehicle could fundamentally change that dynamic.Equally the many thousands of lives that are lost each year to automobile accidents could potentially be eliminated and the cost of automobile insurance could be significantly reduced. Given the choice of owning an automobile with or without accident avoidance, most people would select the enhanced safety model and the greater the proportion of such vehicles on the road the greater the savings in lives, time and money.

Imagine a largely autonomous vehicular travel environment.

Commuters no longer own vehicles, the services are ordered up on a smartphone or similar device by logging the desired time and place of origin and the destination (the quicker the travel time for a given distance, the greater the price). The vehicle could be individually owned or the property of a transit company, a corporation or a charitable organisation.

Ownership becomes somewhat irrelevant and such an environment would create a marketplace that will seek its own level of supply and demand at a competitive price. For the consumer, travel becomes more convenient, more cost-effective, safer and quicker. No longer would an individual be faced with buying a vehicle, insuring it and then risking bodily harm when driving it. There would be no need to maintain it or park it - so there is no need to worry about it being scratched or dented in the parking lot. There may not even be a need for a driver’s license.

Where will the tipping point occur? Perhaps we have already passed it. The current state of autonomous vehicle development is probably not the issue. It is clear that it is happening and we should dedicate our energies to planning for mobility and operating the transportation infrastructure to get the most benefit from all existing assets.

Regulation could be a significant restraint to obtaining this futuristic autonomous environment but control by regulation will be limited and temporary. When viewed without barriers to introduction, autonomous travel is a disruptive technology that will affect both the private and public sectors. Regulation may be introduced to minimise this disruption and smooth the transition but the transformation will continue. The private sector and the public sector can compete or they may support each other through various public private partnerships that focus on mobility and demand rather than the supply of infrastructure.

The only certainty is that in the future we won’t be doing things as we are currently and some great opportunities exist!

Harold Worrall is president of consultancy