The new Apple Pay system will give a major boost to the contactless payment sector, industry experts believe.

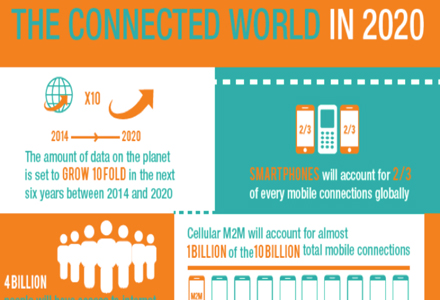

The benefits of such an influential name lending its weight to NFC devices are considerable, says June Yee Felix, president of Verifone Europe. “Apple Pay is something wonderful for our industry,”she told several hundred delegates attending the Opening Summit of CARTES SECURE CONNEXIONS 2014. “They have engaged the consumer. The technology has been there for some time. Others, such as Google, have gone down the same road, but what’s different is that Apple has captured the imagination of the consumer.”She went on: “Having over 200,000 merchants as places to pay in the US alone is a tipping point, I believe, in creating momentum. It will get consumer excitement going and that is very, very important.”The adoption of NFC by major European brands such as Marks & Spencer department stores is also helping the contactless payment market expand. It is reckoned that making a contactless payment is up to 15 times faster than traditional methods using cash or debit cards. Oyvind Rastad, chairman of Eurosmart, the smart security industry’s trade body, also touched on the impact of Apple’s arrival in the market: “It’s great news for the industry.”More widely, he predicts: “Next year will be the year of NFC. I know this is the third time I’ve said this, but NFC is becoming a commercial reality.”Meanwhile, almost two billion chip and pin cards were issued this year, 500 million of them in China alone, he notes. A major migration to chip and pin is also underway in the US, which has clung to the traditional credit card payment method of signing paper receipts. “We see a hyper-connected world, where everyone and everything is connected at all times. By 2020, more than 50% of transactions will be mobile transactions,”Rastad concludes.