Q Why is public transportation ripe for transformation?

A Today, more than half the world’s population lives in cities; that’s a figure set to increase to 70% by 2050. International tourism is also growing, better travel connections are making it easier for us to venture to different cities for holidays and, with employment opportunities and social activities on offer, more and more people are spending time in cities around the world. This increasing trend of urbanization means that cities are facing a number of challenges; overcrowding, congestion, pollution to name a few and the organisations running those cities are considering how to better provide employment, housing, utilities and public transportation for the people who live in and visit them.

If we take urban transportation as an example, today if you visit a different city, be it within Australia or overseas, you have to either queue to purchase a paper ticket or convert your dollars into “travel currency” via a specific transit smart card system, such as the Opal card in Sydney. There are over 300 similar transit smart card systems in operation around the world today and although they have delivered benefits by removing cash from the system, they still have their draw backs. We call these systems “closed-loop” as there is no interoperability across locations and networks. If you live in a city the specific smart card system becomes a way of life but for visitors who need to first purchase a card, guess how much funds they may need to travel and then pre-load money, it’s not so simple. Add to that the wasted funds locked on the cards when visitors return home and the system is not ideal.

For transit agencies locked in the business of processing, distributing and managing such systems, costs and administrative burden is high (around 14% of fares). A more efficient system that removes transit agencies from having to issue dedicated tickets or smartcards, reduces cost and frees investment for service improvements would deliver significant benefits to everyone.

Q How can mobile and payment technologies deliver more convenience and reduce costs?

A We live in ever connected times where today there are about 10 billion connected devices around the globe. With wearable devices that have embedded payments, connected cars and much more, that figure is set to explode to 50 billion by 2020 - we’ve entered a point in time where experience, convenience and immediacy, is key and people want the freedom and more importantly control, to do whatever they want, wherever they are, at any time.

Contactless technology has transformed consumer experience in the retail environment by delivering convenience, speed and simplicity across every day purchases. Merchants now enjoy the increased revenue opportunities and improved customer satisfaction that Contactless provides due to faster check out times and greater efficiencies. With the ability to process high volumes of low value transactions in milliseconds, applying the same technology to the public transportation environment is a natural progression.

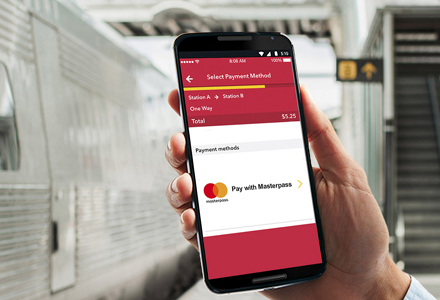

When we travel around our home city or holiday location carrying our mobile device and every day payment card – why should we need to queue to purchase a paper ticket or waste time and money signing up for a smart card service? With global payment standards and digital innovation accessing a public transit services can be as simple as a tap - such systems are globally interoperable, they can be used wherever we are, and as such are referred to as “open-Loop”.

Q What results are being achieved in cities already utilizing these technologies across their public transit systems?

A When it comes to transforming public transit fare collection, mobile and global payment technologies have paved the way for two efficient systems, Contactless “Tap & Go” and mobile ticketing which can be either pay-as-you-go or pre-purchased There are dozens of mobile ticketing implementations across the globe and there are now over 10 complete Contactless “open-loop” ticketing projects, with numerous other deployments in progress, so it is increasingly clear that transit authorities are recognizing that removing themselves from the micro-payments business not only improves customer satisfaction but also creates efficiencies and ultimately reduces their cost of fare collection (COFC).

In London, where an “open-loop” system has been in place since 2014, not only have consumers embraced the technology, with around 7.7 million journeys now made each week using Contactless, but

Although the benefits of Contactless are clear, no two cities are the same and though they experience similar challenges with service demand and fare collection efficiencies there is no one size fits all solution when it comes to delivering smarter city services.

Take New York, where the city has recently transformed its public transportation with the introduction of mobile ticketing. Today MTA eTix is available across the city’s Long Island Rail Road and Metro North lines meaning that the 184 million annual riders now can search for trains, purchase fares for current and future travel and display their tickets all from their mobile device. The advantage with mobile ticketing is that its quick, the system runs off travellers own mobile devices meaning low infrastructure costs and it can be up and running in as little as three months.

Q This is Mastercard’s first involvement with an ITS World Congress, why have you chosen to participate this year?

A As a technology company,

Developing urban experiences that better serve citizens takes collaboration between partners and across industries, there’s no one organisation that can deliver everything a city needs, and that’s why we teamed up with ITS Australia to run the first ever Smart Cities Hackathon tied to the World Congress in Melbourne. Working with the City of Melbourne, RACV, Public Transport Victoria,

Today, at 11am in room 105 we are also holding a Mobile Transport Ticketing for Smart Cities congress session where I’ll be joined by Cubic Transportation Systems, who worked with Transport for London to launch contactless ticketing across the city, and Masabi, who recently worked with the MTA to launch mobile ticketing in New York, to discuss how mobile and banking technologies have the potential to disrupt public transport fare collection. We’ll share examples of cities that have adopted the technologies and discuss the potential for Australian cities.