It is important that we face the facts: revenues generated by fuel taxes in Europe between 1995 and 2020 dropped by more than 50%. This means that these taxes are contributing ‘only’ 4.4% of total taxes raised by governments, compared to 10% generated 15 years ago, according to a recent International Transport Federation report entitled Decarbonisation and the Pricing of Road Transport. This will dramatically impact the funding needed to sustain the continent’s infrastructure and directly correlates to economic prosperity.

To address this, distance-based charging (also referred to as Road User Charge or RUC) is the way forward.

Electric Vehicles and Declining Tax Revenues

It is important to understand how we arrived at our current state of declining fuel tax revenue. It is actually the result of a very positive development: the rise of electric vehicles. In just over 20 years, fuel efficiency improved by 28% in Europe alone (versus 18% in the US). Don’t expect this trend to reverse any time soon as European Union governments continue to push policies with the goal of reaching carbon neutrality by 2050.

A 2022 UK Parliamentary Committee warned that “without reform, policies to deliver net zero emissions by 2050 will result in zero revenue for the Government from motoring taxation. The Committee urges the Government to act now to replace a potential loss of £35 billion to the Exchequer”.

An OECD report noted that the absence of a proper road charging mechanism for EVs will create massive revenue losses for governments and raise social equity issues between ‘traditional’ car owners who contribute to the upkeep of the road infrastructure by paying fuel taxes, and EV owners, who aren’t doing so. It should be noted that, given the expense of electric vehicles, these individuals not paying their fuel taxes are often in a higher economic class than those driving cars fueled by gasoline. The report concluded: “Action to supplement declining fuel-tax revenues is urgent. Governments should apply undifferentiated distance-based charges in the short term.”

History of Distance-based Charging in Europe

Since the inception of its Eurovignette in 1999, Europe has been on the leading front to implement distance-based charging for trucks. Currently eight countries toll trucks by distance and a few more are to join this group (Denmark and the Netherlands). The Alsace region in France will also implement a regional heavy goods vehicles distance-based charge.

Subsequent revisions of this EU directive have led to the progressive internalisation of externalities caused by trucks, which is a good thing as trucks’ external costs are much higher than those caused by cars. According to the OECD study, in Sweden heavy goods vehicles generate between five to 12 times more externalities (wear and tear of the road, crashes, emissions and noise) than cars.

As a result of the above policies, 53% of EU truck freight will be subject to distance-based tolling by 2027. Revenues generated by heavy goods vehicles distance-based schemes amounted to €11.8b in 2022 in Europe. These revenues are set to grow as new such schemes are being rolled out with the support of Global Navigation Satelite System (GNSS).

Lessons from Road Usage Charging Roll-outs around the World

Given the impressive results, the natural evolution would be to expand this approach to all cars. The path may not be that straightforward, however.

Emovis, part of Abertis Mobility Services and a leader in toll-based mobility solutions, has been pioneering distance-based charging for light vehicles as early as 2011 when we took part in UK’s Department for Transport road pricing demonstration project.

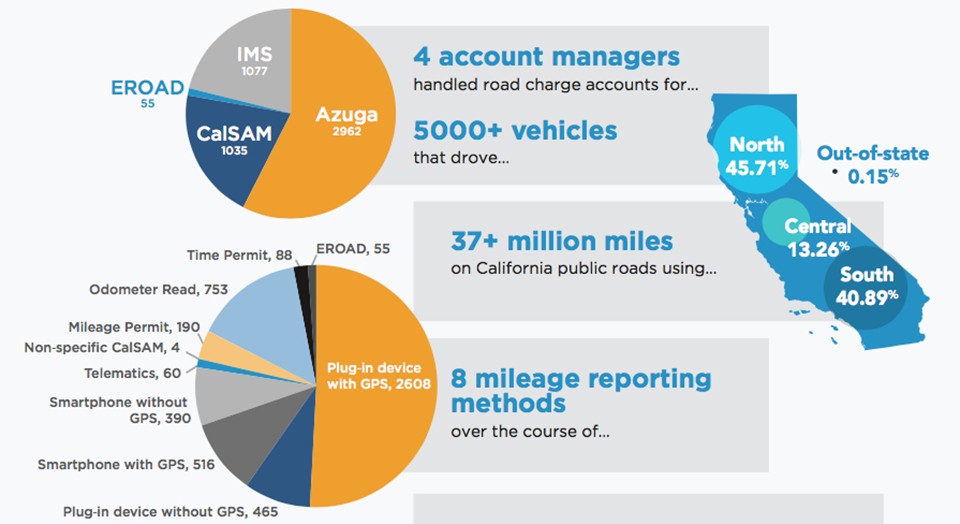

In 2016, Emovis worked with the Oregon Department of Transportation to launch OreGo, the first distance-based programme in Oregon. We currently operate four road user charge schemes in the US: Oregon, Virginia (since 2022), Utah (since 2020) and more recently Oklahoma (since the spring of 2023). We also operated e-tolling schemes in places where there was no toll before (such as Mersey Gateway Crossing in the UK) and the BBV (Blankenburgverbinding) tunnel in the Netherlands (expected to go live in 2024).

Through such experiences, we have gained valuable experience in designing and implementing toll schemes for light vehicles that are both customer-friendly and widely accepted by the general public. We have also seen two blind spots that are often overlooked – revenue compliance and out-of-jurisdiction drivers.

Revenue compliance is key when collecting tolls aimed at financing expensive infrastructure (for reference, revenue from Mersey Gateway Crossing is €695m). Social acceptance is required for the success of a programme. We have witnessed first-hand how tolls are much better accepted and paid for in a timlely manner when users clearly understand the rationale. On Mersey Gateway for instance, revenue compliance has steadily grown to 97%. Policy goals need to be properly articulated and smartly conveyed to the public prior to the launching of the charging programme. This is challenging for nationwide schemes which will impact millions of users.

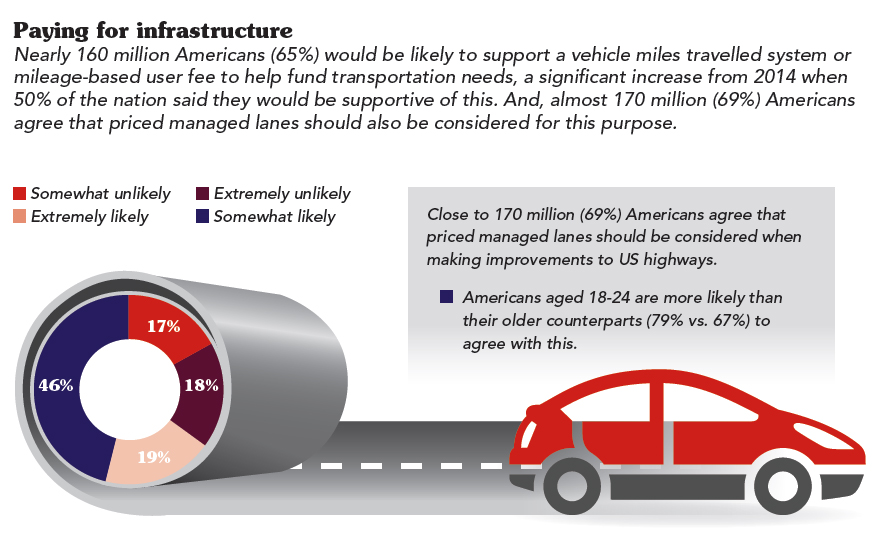

Hence, pilots are very important. The US Transport Research Board study Public Perception of Mileage-Based User Fees notes that a pilot “provides a degree of support for the potential utility of pilot schemes as a mechanism for increasing acceptability”.

We have experienced this ourselves with Virginia’s RUC programme that went live in July 2022. Within just a year, the number of enrolled vehicles jumped by more than 50% (from 10,000 to 15,500) and with a low attrition rate (below 10%). This was the result of the public support garnered during the pilot.

Revenue compliance is obviously not just about social acceptance. It also requires robust enforcement processes and adequate regulatory frameworks to combat inevitable frauds. Here we can certainly leverage the frameworks and experiences from free-flow tolling in Europe.

It is critical that payment is received from out-of-jurisdiction drivers – foreign cars travelling in a country where a distance-based charge is in operation. This is critical to the success of nationwide car distance-based charge programme. It ensures fairness: foreign drivers pay their fair share and domestic drivers are not being unduly charged.

Up to now, this aspect has not yet been taken into account in the current US RUC programmes. As in and out-of-states miles are counted alike. In Europe, this matter has been tackled through the creation of dedicated service providers whose roles consist in providing either pan-European toll services (EETS) or regional toll services (ETS) using predominantly telematic devices.

This market-driven approach has led to the creation of large EU players – such as Telepass, DKV, Axxès, Edenred, Shell and TotalEnergies – which together collect around 25% of truck tolls in Europe according to Ptolemus Consulting. Not only do these private service providers manage domestic and foreign trucks, but thanks to a range of value-added services, they collect tolls on behalf of road infrastructure owners at a range between 0.5% and 2%. By comparison, the cost of collecting fuel taxes is estimated at 1-3% in the US.

The Way Forward

There are some big challenges that come with moving to an all-vehicle distance based charge in Euope. There is an enormous sum of revenue to collect and consequently a huge number of road users to manage.

Fuel taxes in Europe amount to about €240 billion annually. Compensating half of the fuel taxes would mean collecting €120bn though road user charging. That is 10 times what is being currently collected from GNSS truck tolls Europe (€11.8bn). The gap is even larger if we consider the number of road users at stake: there are 253 million passenger cars and 6.2 million trucks in Europe. That is 40 times more vehicles to manage!

Nevertheless, revenue must be generated by implementing distance-based charges for light vehicles. All the stakeholders involved must work in collaboration to address the various hurdles. It shouldn’t be viewed as a “nice to have”, rather as a necessity to achieving Europe’s road decarbonisation goals, while generating sustainable road funding in the long run. European policymakers should take advantage of the existing tolling regulatory framework and US RUC initiatives to design effective distance-based charge scheme for all vehicles. Nationwide distance based-charge programmes require a public-private approach to address out-of-jurisdiction drivers and deliver cost effective scheme.

We shared some daunting figures to start this piece. We can only imagine how this article would read if we were to re-write it in the future after road usage charging has been implemented in Europe for all vehicles. We can confidently assume that as policymakers’ bold actions are addressing critical environmental concerns, revenues from RUC programmes are funding the infrastructure to ensure economic development.

ABOUT THE AUTHOR

Benoît Rossi (MPP) is Director of Business Development for emovis (Abertis Mobility Services). Learn more at www.emovis.com

Content produced in association with emovis