Bus travel booking is moving into the digital age as David Crawford discovers.

A global surge in demand for intercity bus travel is fuelling new initiatives to make it easier for passengers to access information and book via the web by, fo example, using multi-sourced metasearch engines that scan other sector engines. Factors driving the boom include competitive bus fares as compared with other modes; the introduction of modern, comfortable vehicles and the availability of amenities such as on-board Wi-Fi and power sockets - now standard on all US

In another feature aimed at pleasing long-distance passengers, Greyhound’s GPS-based BusTracker feature enables passengers to keep abreast of their vehicle’s progress and anticipated arrival time. Again in the US,

Globally, two major ticket aggregator websites, US-based Wanderu and Canada HQ’d Busbud, have introduced apps for mobile bookings, along the lines of those made available by the likes of Uber and Lyft. In its ‘Remaking of the motor coach: 2015 Year in Review of Intercity Bus Service in the US’ the Chaddick Institute at Chicago’s DePaul University notes farsighted operators’ willingness to invest in previously unpromising-looking routes up to five years ahead of expectations of financial selfsufficiency. Among examples are the regions around Atlanta and Pittsburgh.

A key feature of this thrust involves switching to convenient kerbside pick-up and drop-off locations in resurgent city centres, rather than using traditional bus terminals. The payoff is that up to half of today’s riders in the traditionally car-dominated US are affluent millennials, in contrast to a generation ago when the overwhelming presence was the urban and rural poor.

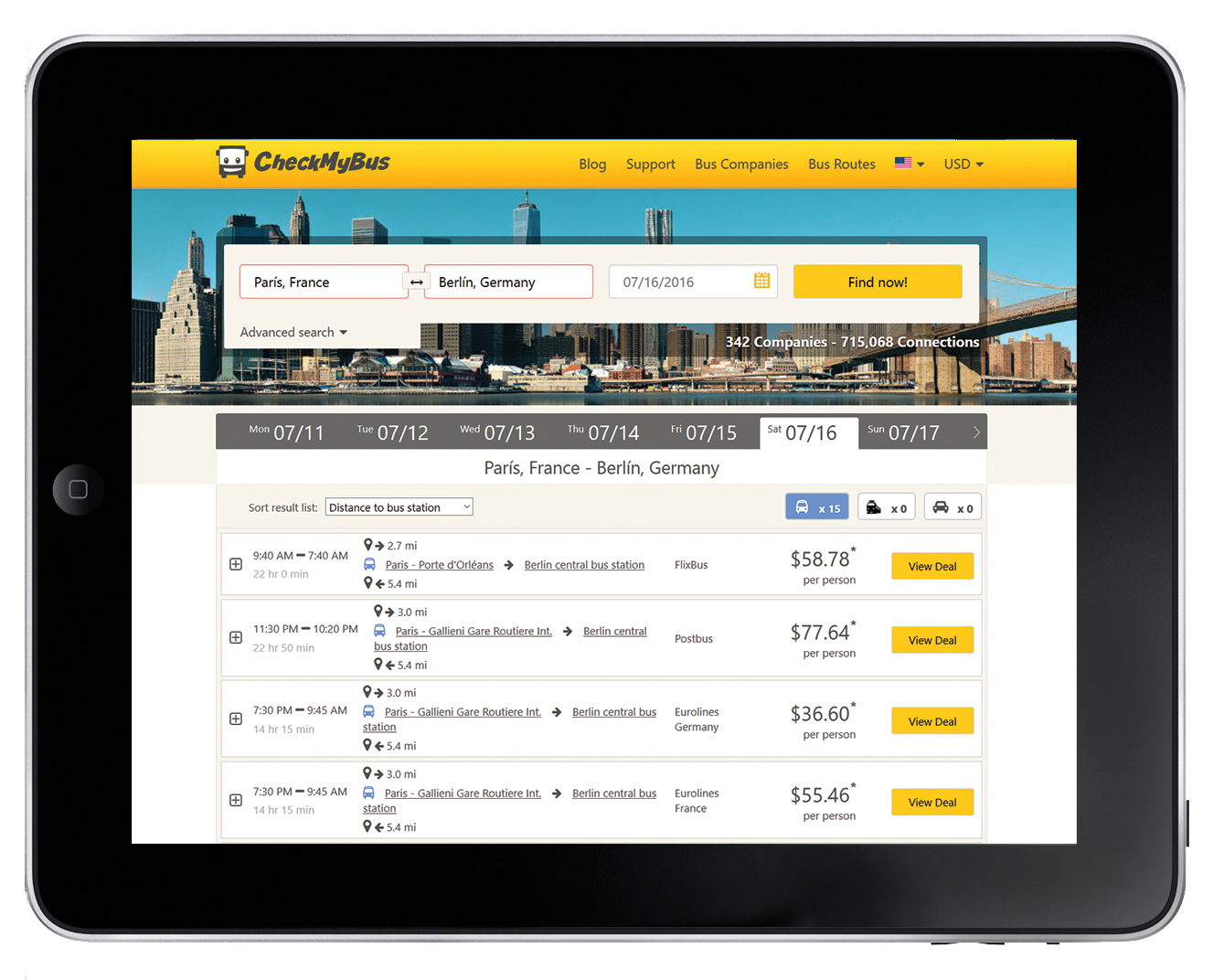

These new riders want modern booking. According to US digital researchers L2, 39% of millennials now source their travel via metasearch engines rather than direct via on-line travel agencies (OTAs) or brand sites, compared to only 23% of baby boomers. In Europe, a key driver in passenger growth has been the recent deregulation of the long-distance bus service market in countries including Germany, where the move has sparked the emergence of Nuremburgbased CheckMyBus’ intercity metasearch engine. The company has recently expanded its geographical reach from Europe into Latin America, initially through sales partnerships with regional bus ticketing platform ClickBus.

The first of these began operating in Brazil, in time for the 2016 Rio Olympics. CheckMyBus CEO Marc Hoffman told ITS International: “We saw a good flow of international searches for connections across the country, coming mainly from the US, followed by Western Europe, then Argentina.” The second such partnership is in Mexico. According to ClickBus founder and CEO Fernando Prado, both markets have traditionally been “extremely fragmented”.

In support, CheckMyBus has launched the new, multilingual %$Linker:

In July 2016, CheckMyBus highlighted the financial attractiveness of the travel metasearch concept when it announced a seven-digit funding round with Luxembourgbased venture capital investor Howzat and the Swiss-based Angelgate club of entrepreneurs. Howzat focuses on digital market opportunities, and partner Sascha Hausmann told ITS International he believes that, “with great scalability and superior content for users, metasearch will be a bus-market success story comparable to those we have seen for hotels or flights.”

The new funding will enable CheckMyBus to take advantage of further expected growth in what Hoffman sees as continuing to be the cheapest mode of public transportation in most countries, “with the most successful players creating a highly positive image for the industry. As a metasearch engine, we integrate content from bus providers directly but also from OTAs such as ClickBus. “We don’t execute ticket bookings ourselves, and such partnerships are beneficial for both parties. The split already works well in other travel segments such as the hotel and flight industries, with successful companies such as Trivago and Skyscanner.” The partnership, he says, “has been a good start for us in getting active in Latin America; while, for Clickbus, it is a great way to distribute their regional bus content globally. Mexican tourism, for example, is as popular as ever.”

He also sees the new collaboration being particularly beneficial for US travellers as the partnership service links cross-border routes originating in the US with new domestic connections within Mexico on a single platform. There are also growing reverse flows of Mexican tourists to the US.

Founded in August 2013 with support from German digital startup accelerator Rocket Internet, ClickBus currently operates in Colombia and Turkey, as well as in Brazil (where it now offers travellers over 6,000

bus routes) and Mexico.

The new partnership plans to extend its offer within the US and Europe, as well as Latin America and, in time, other world regions. Hoffman believes that the metasearch approach will drive “extraordinary growth” in the inter-city bus market over the coming years. To set this in context, in a global bus travel market worth US$70bn, some 90% of bookings are still processed offline.

A new refinement offered by the company can provide train and carpooling options to users if no bus operator is available on a particular route, “which can represent a good alternative depending on availability or the duration of the trip. Our customers are happy to have the choice, which is also reflected in sales,” said Hoffmann.

Quizzed on future opportunities for such intermodal options, he cited trends away from individual travel by car to a more flexible mobility mix. “We are at the beginning of a fundamental change in the market. Users with a specific need will pick the mode that makes most sense at a given time.” His vision evokes the emerging Mobility as a Service (MaaS) model, where subscribers buy a travel ‘budget’ and spend it as they wish. Does he see opportunities to interface with this?

“MaaS”, he replied, “is starting to become a reality, at the urban level – but initially in the form of delivering multimodal travel information for consumers. More and more people are travelling smart, and services such as ours make their lives easier, by giving fast and easily available information support.

“But the burdens for a provider who wants to be a merchant in a complex travel chain are still very high. Think about the issue of giving refunds if anything in a chain of, say five different providers goes wrong. I therefore believe that information will take the lead – for now.

Regulatory shifts

In the legislative arena, Europe had, until recently, suffered from a highly-fragmented and inconsistent set of regulatory frameworks for intercity bus travel, more so than in any other form of land-based public transport. Prior to 2013, for example, German law restricted long-distance bus services to routes that were not adequately served by the country's densely developed rail network. This was to protect the market for the national rail operator, Deutsche Bundesbahn, which lost its privileged status in January of that year. The resulting upsurge in 50km-plus bus journeys, which had risen by 180% by the end of the year, has been particularly evident in the opening of new direct airport links.

The French Competition Authority followed suit in August 2015, with legislation allowing intercity buses the freedom to run long-distance domestic routes. Previously, operators had to demonstrate that at least half of their passengers were en-route to international destinations.

In 2013, only some 110,000 domestic travellers a year were using intercity buses; but the French Government now expects the annual tally to rise to five million. A key factor in its decision was its conclusion that, in contrast with the German situation, its internal long-distance bus services were more complementary to, than competing with, rail.

Spain, which has traditionally had a strong intercity bus market (though one coming under increasing competition from rail) has liberalised this to a degree, with discussions under way on a still more open model. There are also moves that could bring Austria into line with other countries in Western Europe.

- ABOUT THE AUTHOR: David Crawford has spent 20 years writing about and researching ITS and is a Contributing Editor to ITS International