David Crawford records an upsurge in ground travel.

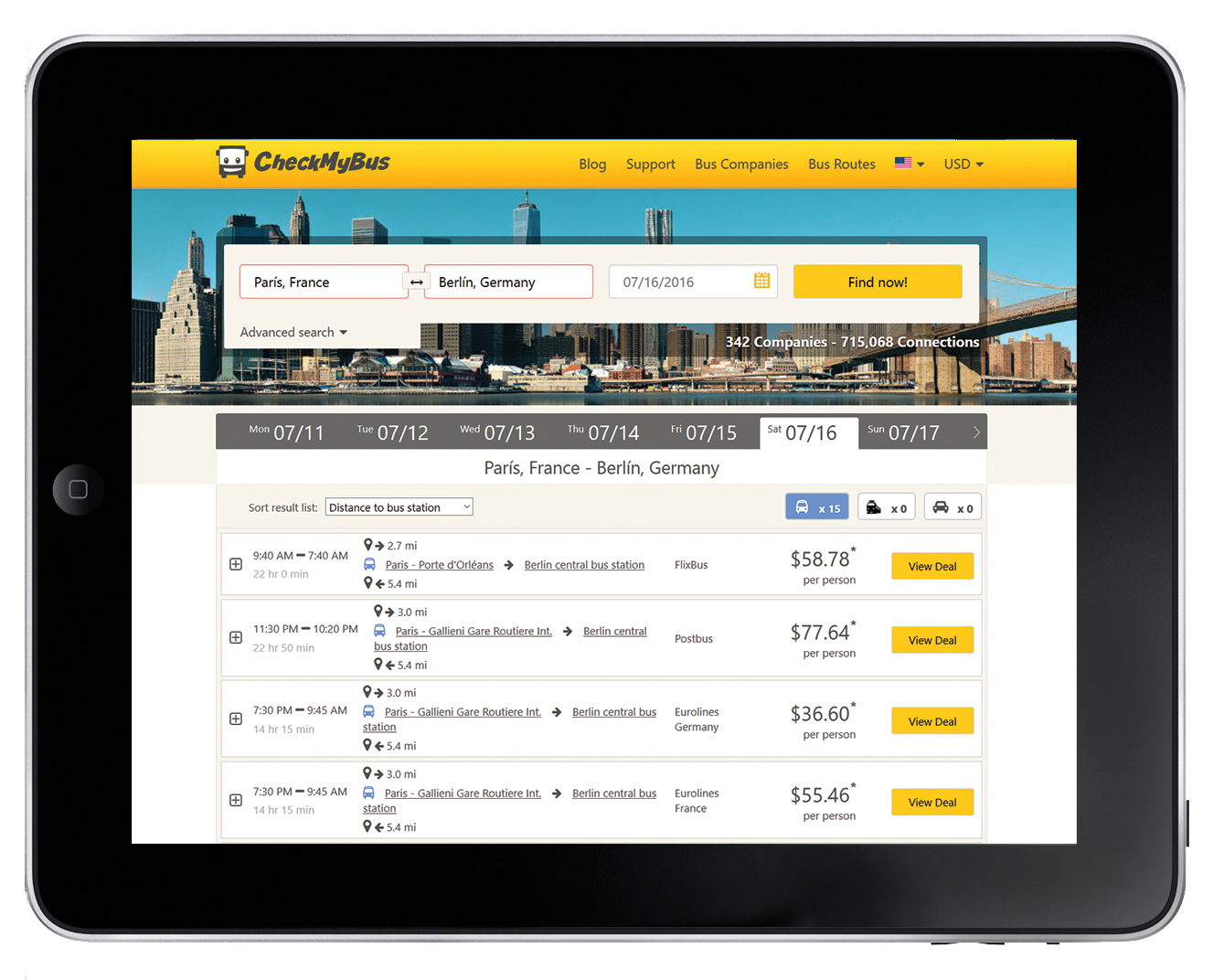

Express buses are powering ahead of air and rail as the US’ most-favoured form of intercity travel and major operators are investing in passenger-attracting and retaining technologies. At the same time ‘kayak’-style price comparison websites are emerging to widen rider choice. Modelled on airline industry search engines that find cheap flight deals by comparing carriers’ offers, these new websites aim to fill the same gap for a ground-travel equivalent

Megabus passengers make good use of wifi

David Crawford records an upsurge in ground travel.

Express buses are powering ahead of air and rail as the US’ most-favoured form of intercity travel and major operators are investing in passenger-attracting and retaining technologies. At the same time ‘kayak’-style price comparison websites are emerging to widen rider choice. Modelled on airline industry search engines that find cheap flight deals by comparing carriers’ offers, these new websites aim to fill the same gap for a ground-travel equivalent for a growing ridership.

A survey by the US5628 National Transportation Safety Board has found that 750 million people a year are travelling by intercity bus compared with 730 million flying between cities. Again, the bus was the fastest-growing form of US intercity travel in 2012, according to a 2013 report from the 649 Chaddick Institute for Metropolitan Development at Chicago’s DePaul University. It found that scheduled departures were up 7.5%, the most in four years.

However, this has not always been the case as between 1980 and 2006, the industry had declined by an average 2.9% a year but subsequently it has grown by up to 9.8% a year. “Buses have gone from a niche product to a national force,” says Joseph Schwieterman director at the Chaddick Institute.

Curbside express companies such as2010 Boltbus, 653 DC2NY Bus and 651 Megabus, which pick up at the roadside rather than bus stations, account for much of the increase. All companies are now targeting the 3.3 billion intercity trips a year currently taken by car or plane.

The demographics have also changed dramatically. Ten years ago, riders were predominantly those that couldn’t afford other forms of travel, typically the elderly. More recently, most have been in the 18-35 age bracket, with operators routinely providing internet booking and in-trip plugs and Wi-Fi, as well as introducing travel information services.

The Chaddick Institute’s Technology in Intercity Travel Study – 2013 Update shows that last year the proportion of passengers on long-distance buses using such technology has surged to reach 43% and over, compared with 35% on airlines. To capitalise and consolidate on the trend, Megabus claims an industry first in releasing its own free app.

Developed by US-based Saucon Technologies from Philadelphia, the app enables passengers to plan and save trips, input origin and destination cities and travel times, confirm pick-up points, track bus locations and see the expected arrival times. While the app can’t currently be used to buy tickets, passengers can do so online by accessing the Megabus.com mobile site via their internet-enabled computers or smartphones.

The company also runs an active social media programme with dedicated service representatives that alert passengers to ticket releases and sales, pick-up/set-down location changes and service disruptions.

2009 Greyhound sub-brand Boltbus has an app, created in partnership with a specialist developer, which is due out on 1812 Android and iPhone “imminently”, according to Greyhound chief information officer Chris Boult. It will add the capability to buy tickets in a subsequent release.

As a social media user, the company aims for quick response. “Our social media group”, says Boult, “is briefed to react to passengers’ problems and, if possible, intervene before they get off the bus.” The company is also weighing up kayak offers.

DC2NY, which runs services between Washington DC and New York, has just launched a mobile version of its website. It also runs a monthly web poll on retaining its rider vote option for or against an intermediate rest stop.

1846 ITS International: “We currently have agreements with over a dozen US companies”.

A European operation, with routes in France, Germany and The Netherlands, was due to go live in September 2013. “We’re also looking to South America, most likely Brazil”, he continued. “We’d like to have a strong presence there before the 2016 Rio Olympics.

“At the same time, we’re focussing heavily on developing a service for charter services – an enormous market. We also have new technology in the works that we do not wish to disclose at this time – but I can tell you in four words: ‘Mobile first, game changer’”.

Another start-up, Wanderu, launched publicly in Summer 2013. It currently has 12 partners, including Go Buses, Concord Coach Lines and Trailways of New York, which gives it 80% coverage in the Northeast US. It has introduced a pre-booking ‘check-out’ to ensure passengers have a seat on the services with a system of advanced reservations.

Both companies stress the scale of the data handling task and the need for standards to manage it. Says Silverstein: “The reason no one has successfully done this in the past is because no one has taken the time to build a real business and a sustainable, scalable, process to handle data. We felt that it was worth pursuing and developed the technology”.

Wanderu co-founder and CEO Polina Raygorodskaya says: “Aggregating bus information has been complicated. We’ve had to start from scratch, because there are no application programming interfaces.”

Both have built data systems similar to those created for the airline world by ITA (the travel industry software division which1691 Google acquired in 2011). The technology is designed to handle millions of data points, standardise data and support advanced routing algorithms to allow people to search for travel options between two points. Both the bus kayak companies have introduced their own standards systems (Wanderu has Wanderu Unified Standards) for integrating and formatting data points. Says Raygorodskaya: “We have been approached by major travel companies interested in using our system, as well as large transportation companies interested in licensing our routing technology for their own operations.” Wanderu is planning a mobile app for release this winter.

Apps are seen as being critical to meet the needs of the large numbers of travellers booking at the last minute. During beta testing, Wanderu found about 25% of passengers were leaving their bookings to the last minute.

One competing start-up, BusCatchers, set up to extract data directly from operators’ sites, has closed down under legal pressure from bus carriers citing terms of use agreements on their data. Income was to be derived from advertising. Founder Nico Jimenez now plans a new incarnation. He says the reincarnation will be a legal site dedicated to web extraction software development with the source codes for extraction from the websites of major operators. He plans that the new site will also be supported by advertising.

Before www.buscatchers.com was shut down, Jimenez had already published a preliminary version of the source code that allowed it to work on Github, a web-based hosting service for software development projects. He also plans to develop a python programming language framework.

A long-term future stage he foresees is fully automatic extraction using artificial intelligence (AI). Jason Eisner, of the Department of Computer Science at John Hopkins University, told ITS International: “Where there is vast amounts of data that need extracting, standardising and formatting, AI techniques should be able to help. An alternative is for the bus companies to provide their data in a standardised format.”

Says Brian Antholin, who uses bus comparison websites in his CoTo Travel student college tour business: “The continued development of these, and apps, is essential for the continued growth and sustainability of intercity bus travel. It has been able to obtain an edge over other transport modes because of its willingness to embrace and adapt new business models that involve technology rather quickly”.

Express buses are powering ahead of air and rail as the US’ most-favoured form of intercity travel and major operators are investing in passenger-attracting and retaining technologies. At the same time ‘kayak’-style price comparison websites are emerging to widen rider choice. Modelled on airline industry search engines that find cheap flight deals by comparing carriers’ offers, these new websites aim to fill the same gap for a ground-travel equivalent for a growing ridership.

A survey by the US

However, this has not always been the case as between 1980 and 2006, the industry had declined by an average 2.9% a year but subsequently it has grown by up to 9.8% a year. “Buses have gone from a niche product to a national force,” says Joseph Schwieterman director at the Chaddick Institute.

Curbside express companies such as

The demographics have also changed dramatically. Ten years ago, riders were predominantly those that couldn’t afford other forms of travel, typically the elderly. More recently, most have been in the 18-35 age bracket, with operators routinely providing internet booking and in-trip plugs and Wi-Fi, as well as introducing travel information services.

The Chaddick Institute’s Technology in Intercity Travel Study – 2013 Update shows that last year the proportion of passengers on long-distance buses using such technology has surged to reach 43% and over, compared with 35% on airlines. To capitalise and consolidate on the trend, Megabus claims an industry first in releasing its own free app.

Developed by US-based Saucon Technologies from Philadelphia, the app enables passengers to plan and save trips, input origin and destination cities and travel times, confirm pick-up points, track bus locations and see the expected arrival times. While the app can’t currently be used to buy tickets, passengers can do so online by accessing the Megabus.com mobile site via their internet-enabled computers or smartphones.

The company also runs an active social media programme with dedicated service representatives that alert passengers to ticket releases and sales, pick-up/set-down location changes and service disruptions.

As a social media user, the company aims for quick response. “Our social media group”, says Boult, “is briefed to react to passengers’ problems and, if possible, intervene before they get off the bus.” The company is also weighing up kayak offers.

DC2NY, which runs services between Washington DC and New York, has just launched a mobile version of its website. It also runs a monthly web poll on retaining its rider vote option for or against an intermediate rest stop.

Comparisons

2013 has proved a growth year for comparison websites, competing for a share of partner operators’ referral fees for helping process the North American tally of US$20bn worth of intercity ground travel tickets. Bustripping was early in the field, with a website launched in May 2013, and a completed iPhone app due for release with an Android version to follow. The company’s CEO, Ben Silverstein, toldA European operation, with routes in France, Germany and The Netherlands, was due to go live in September 2013. “We’re also looking to South America, most likely Brazil”, he continued. “We’d like to have a strong presence there before the 2016 Rio Olympics.

“At the same time, we’re focussing heavily on developing a service for charter services – an enormous market. We also have new technology in the works that we do not wish to disclose at this time – but I can tell you in four words: ‘Mobile first, game changer’”.

Another start-up, Wanderu, launched publicly in Summer 2013. It currently has 12 partners, including Go Buses, Concord Coach Lines and Trailways of New York, which gives it 80% coverage in the Northeast US. It has introduced a pre-booking ‘check-out’ to ensure passengers have a seat on the services with a system of advanced reservations.

Both companies stress the scale of the data handling task and the need for standards to manage it. Says Silverstein: “The reason no one has successfully done this in the past is because no one has taken the time to build a real business and a sustainable, scalable, process to handle data. We felt that it was worth pursuing and developed the technology”.

Wanderu co-founder and CEO Polina Raygorodskaya says: “Aggregating bus information has been complicated. We’ve had to start from scratch, because there are no application programming interfaces.”

Both have built data systems similar to those created for the airline world by ITA (the travel industry software division which

Apps are seen as being critical to meet the needs of the large numbers of travellers booking at the last minute. During beta testing, Wanderu found about 25% of passengers were leaving their bookings to the last minute.

One competing start-up, BusCatchers, set up to extract data directly from operators’ sites, has closed down under legal pressure from bus carriers citing terms of use agreements on their data. Income was to be derived from advertising. Founder Nico Jimenez now plans a new incarnation. He says the reincarnation will be a legal site dedicated to web extraction software development with the source codes for extraction from the websites of major operators. He plans that the new site will also be supported by advertising.

Before www.buscatchers.com was shut down, Jimenez had already published a preliminary version of the source code that allowed it to work on Github, a web-based hosting service for software development projects. He also plans to develop a python programming language framework.

A long-term future stage he foresees is fully automatic extraction using artificial intelligence (AI). Jason Eisner, of the Department of Computer Science at John Hopkins University, told ITS International: “Where there is vast amounts of data that need extracting, standardising and formatting, AI techniques should be able to help. An alternative is for the bus companies to provide their data in a standardised format.”

Says Brian Antholin, who uses bus comparison websites in his CoTo Travel student college tour business: “The continued development of these, and apps, is essential for the continued growth and sustainability of intercity bus travel. It has been able to obtain an edge over other transport modes because of its willingness to embrace and adapt new business models that involve technology rather quickly”.