Ten years ago, on 1 July 2013, HU-GO, the national truck tolling system in Hungary, went live.

It was a completely new concept compared to all other truck tolling schemes in operation at that time. Instead of a single toll authority operating the system on its own, issuing dedicated toll on-board units and collecting money directly from road users, Hungary decided to establish an ‘open marketplace’ model. It invited fleet telematics service providers to partner, allowing the authority to leverage existing GNSS equipment for toll collection. Rather than installing a dedicated toll box, trucking companies could simply reuse their existing fleet tracking devices to pay.

At the time, the European toll industry was suspicious about whether or not this would result in a high rate of ‘toll leakage’, given several stakeholders have to work hand-in-hand. But everybody immediately saw the benefits for all parties: trucking companies could reuse existing tracking devices, telematics service providers could offer a value-added service and the national authority could lower costs by leveraging in-vehicle equipment and by having fleet telematics partners taking care of user management.

Now, 10 years later, GNSS toll systems seem to have become the standard for trucks in Europe. Hungary, Bulgaria and Poland have also implemented national schemes based on the same model, and lately Switzerland and the Netherlands announced plans to collect truck tolls using third-party service providers.

Bring your own device

Hungary’s HU-GO was designed to be a flexible system, implemented in the shortest possible time and with the lowest possible cost. The designers chose GNSS as the base technology, drastically reducing the need for field equipment while at the same time ensuring the tolled road network could be easily extended as new roads were built. In addition, investment could be further decreased by partnering with fleet telematic companies, leveraging the data generated by fleet tracking devices for toll collection. So instead of purchasing and installing hundreds of thousands of dedicated GNSS toll on-board units, the Hungarian authorities followed a ‘Bring your own device’ approach, allowing road users to pay tolls via their existing service providers and in-vehicle equipment.

Bence Marczin from NTPS (Hungarian National Toll Authority) explains: “The experiences and devices of fleet-tracking companies made the HU-GO system extremely quick and cost-effective to implement. And thanks to the outsourced tasks performed and services provided by our partners, we are able to keep our company’s costs low. Such services include, for example, the operation of call centres or the development, installation and servicing of on-board units.”

For the Polish government, flexibility and system costs have been the main drivers for choosing a similar system for its second-generation truck tolling scheme - e-Toll - which went live at the end of 2021.

Poland had been operating a truck tolling system based on DSRC technology for 10 years. According to the Polish government the set-up costs for the new system have only been 10-15% compared to the previous one as there is much less need for roadside infrastructure (for enforcement purposes only) and existing fleet tracking on-board units as well as a smartphone app are being used instead of dedicated toll on-board units financed by the toll authority.

EETS pushes toll agencies

Besides the cost benefits listed above, the trend towards open tolling schemes is further being fuelled by EETS (European Electronic Toll Service). The relevant EU Directive requires toll system operators in all EU member states to accept third-party toll service providers in their domain. While some toll agencies have been reluctant in opening up their systems for those EETS providers in the past, most countries with truck tolling schemes in Europe nowadays have ‘EETS-enabled’ their systems. As a result, road users have various options for paying tolls in those countries.

In Poland, truckers and fleet operators can either use an existing telematics device from a registered local fleet telematics service provider or they can sign up with an EETS provider. And users who want to use their smartphone instead of a dedicated device can download the e-Toll app.

Being future ready

Another driver behind open tolling schemes in Europe is the increasing number of connected and automated vehicles (C/AVs). Switzerland is currently tendering its next-generation nationwide truck tolling system. For Bruno Hofstetter from the Swiss BAZG (Bundesamt für Zoll und Grenzsicherheit), Switzerland is best prepared for the future with a GNSS-based solution in combination with an open model leveraging service providers.

“Switzerland has been one of the pioneers in truck tolling in Europe,” he explains. “We launched our first system in 2001 which will now be replaced by a next-generation system. As the new system is also supposed to be in use for 20-plus years, one of the main requirements we have is future-readiness. With connected vehicles and upcoming automated driving it is obvious that vehicles will produce very accurate trip data and that such data could be used for toll calculation in the future. When we started to plan our next-generation truck tolling system we felt it would be rather anachronistic if we would still foresee dedicated aftermarket toll devices as being the tool to detect where a vehicle had driven - rather than to leverage the data modern vehicles generate with their in-vehicle telematics equipment, which is often way more accurate.”

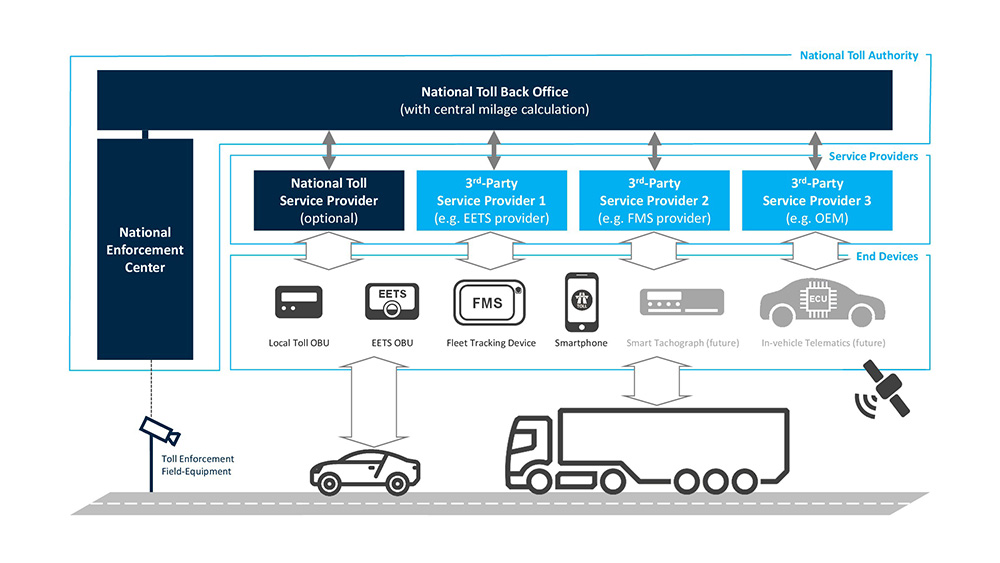

Switzerland’s new system will be solely GNSS-based, with the driven distance of vehicles derived from their tracking data using a central distance (mileage) calculation software. “The data we need is provided to us centre-to-centre by the platforms of the service providers we work with,” Hofstetter says.

“Once we know how much a truck has driven on our roads we can then calculate the amount of toll the vehicle has to pay, taking parameters like maximum vehicle weight - as well as the emission class of its engine - into account. We leave it to the service providers as to what technology they want to generate the trip data we need in order to calculate tolls. While some service providers will still use dedicated aftermarket devices, others may start to collaborate with vehicle manufacturers to get direct access to this type of data from native in-vehicle telematics systems like telematics control units, smart tachographs and the like.”

He expects to partner with EETS and fleet telematics service providers, fleet card issuers or even truck OEMs offering value-added vehicle and fleet services.

“The new concept requires some rethinking on toll agencies' side,” Hofstetter adds. “For us, central distance calculation based on incoming vehicle tracks, toll calculation and enforcement are all critical tasks we want to have fully under control - while vehicle tracing and user management are things we believe can be easily outsourced to third parties. In order to be attractive for a broad spectrum of service providers we have tried to simplify the registration process for such partners as much as possible. We have defined clear and easy-to-use data interfaces and – probably most important – we offer a commercial framework with a compensation model ensuring an attractive business case for service providers.”

New business opportunities

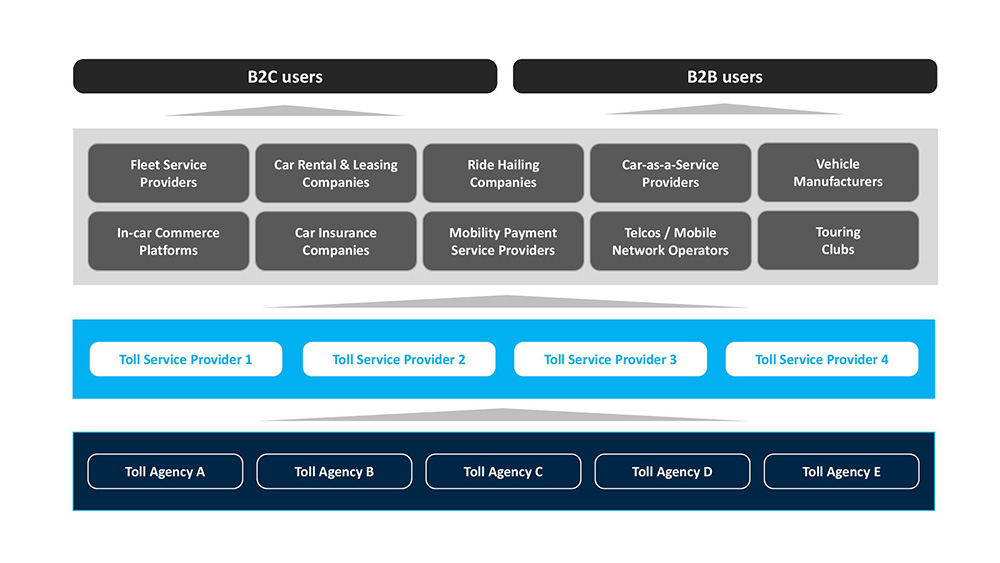

The trend towards GNSS-based open tolling schemes opens the door for new business opportunities for fleet and mobility service providers: automotive companies, fleet card issuers, fleet management companies, rental car vendors, mobility payment service providers, touring clubs and insurance companies. Many of those players offer fleet and mobility services and have started to enlarge their service portfolio, thereby becoming a one-stop shop for their clients.

For most of them toll payment is a very interesting value-added service allowing them to complement their portfolio and to ensure a seamless and comprehensive user experience. Audi US, for example, has started to embed toll payment functions into its vehicles and MAN Truck & Bus in Europe just announced that MAN SimplePay, a digital wallet for all payment transactions in everyday trucking, will be enhanced by an EU-wide toll payment function. Many European fleet card companies already provide toll payment services and first-fleet telematics companies have started to add them too.

While a few players develop their own toll payment capability, most partner with toll service providers which take care of the interaction with toll agencies and are able to provide a universal toll payment function which works across all relevant toll domains. This means fleet and mobility services players can add toll payment to their portfolio quickly and with little effort and leave all the complexity (platform development, system certification, etc) to the toll services provider they are partnering with.

Implications for the tolling industry

The developments in Europe come with a lot of implications both for toll system vendors as well as operators. While in the past there was a single client - the toll agency - which was sourcing a complete end-to-end solution, including on-board units, roadside stations and a back-office system and which may have outsourced operations to the solution vendor, the new model works based on an ecosystem of companies working hand-in-hand.

In the case of GNSS-based open toll systems, there is no longer a single client with a single monolithic system. Instead, there are several building blocks operated by several players. Consequently, the delivery scope of a toll system vendor towards the toll agency is being drastically reduced to a central platform with mileage calculation and clearing functionality and to field equipment which is needed for enforcement purposes. On the other hand, toll service providers (e.g. EETS providers) emerge as a new target group which can be served with on-board equipment, apps and respective back-office platforms.

Offering system operations may still be possible but is likely limited as road user management will be done by the third-party service providers. The Swiss authorities, for example, outsource the entire enforcement operation and will have a partner operating their own national toll service as an alternative for road users who don’t want to sign up with any of the commercial third-party service providers.

Is this the future?

Deploying tolling systems using GNSS technology and based on an open-market place model comes with a lot of advantages for toll agencies and service providers as well as road users. Therefore we can expect to see more and more of them in the future and, ultimately, they will become the standard way of collecting tolls in the long run. However, given that most toll agencies are conservative and risk-averse it may take decades until we are there.

Besides the bespoke European truck tolling systems we can find several other examples where toll agencies collaborate with service providers so that, in fact, open-marketplace models are quite common already. Many European countries have multiple toll concessions and toll service providers, like Telepass in Italy, ViaVerde in Portugal, Bip&Drive and Pagatelia in Spain or APRR, Bip&Go, Easytrip or Ulys in France which offer road users a possibility to pay tolls electronically in all domains using a single account.

In the US, there are a variety of toll service providers like Bancpass, Bestpass and Verra Mobility providing B2B and B2C users a payment option which works in many toll domains across the country. And in other regions, banks often issue on-board units and collect toll payments in cooperation with local toll agencies.

However, in all those cases the service providers use still dedicated toll on-board units and tags based on DSRC or RFID technology - rather than leveraging existing GNSS devices or smartphones, which limits the possibilities for service providers.

Automotive companies are usually interested in embedding toll payment as a feature to new car models – until they realise they would have to integrate a proprietary toll technology into the car rather than using the existing GNSS data which each modern vehicle can provide today ‘out-of-the-box’.

Given the massive investments toll agencies have undertaken into DSRC- and RFID-based toll systems and the sceptical position many agencies have regarding GNSS technology, it will be a slow process to move towards a more open - and more innovative - tolling world.

That said, the emerging toll payment apps in North America like EcoToll, GoToll, Paytollo or Uproad, which operate and offer their service in parallel to existing toll agencies, are promising.

This ‘hybrid’ model may be the blueprint for all agencies which want to open their systems and better support the overall developments and trends in the broader ITS and mobility space: like smartphones becoming the natural go-to travel companion for many users, connected cars, automated driving, Mobility as a Service (MaaS), and Internet of Things and GNSS being core technologies of most mobility applications.

It is worth pointing out that toll enforcement will become more important in order to minimise fraud in ‘open’ toll systems; but these systems - in which authorities partner with third-party service providers - will likely also be a possible model for future congestion charging/low-emission zone schemes, supporting the trend towards broader and integrated MaaS offerings in cities.

The same goes for future road usage charging schemes: in US states such as Oregon, authorities partner with so-called commercial account managers in charge of user management, who capture mileage, collect mileage-based user fees/tax payments and possibly offer value-added services to road users.

Whatever shape the future takes, by moving away from closed silo thinking towards an open and collaborative approach supporting modern user-centric mobility ecosystems, toll agencies can make an important contribution in further shaping the new mobility world where users are being seamlessly supported when moving from A to B.

About the Author:

Peter Ummenhofer is managing director and founder of GO Consulting. During his career in ITS and mobility he has also worked for Kapsch TrafficCom and PTV Group

European Electronic Toll Service

The European Electronic Toll Service allows road users to pay tolls throughout Europe, signing a single contract with an EETS provider of their choice using a single universal onboard unit. Rather than paying tolls directly to the road authorities, the user gets a single invoice from the EETS provider which is clearing the money with all toll agencies through whose domains the road user has driven through.

Primary target users for EETS today are fleet operators with long-haul trucks doing cross-border tours across multiple European countries. In addition, EETS will also be used by providers of connected car services, fleet services as well as other mobility services which operate in multiple EU countries in the future. Those providers are seeking a universal toll payment option covering all EU countries allowing them to reduce complexity in integrating and operating a toll payment function.

As of today, there are 16 EETS providers registered in Europe. However, only a handful of them is currently offering a respective service with a broad geographical coverage.