Is the end for dedicated, in-vehicle telematics systems now in sight? Some seemed to think so at the recent Telematics Munich 2012 conference… Geoff Hadwick reports. Forget smartphone apps – leave that sort of thing to Apple and Google,” Roger Lanctot, associate director of the global automotive practice at consultancy Strategy Analytics told more than 700 delegates in Munich last month at the Telematics Munich 2012 conference. They are a waste of time and money, he said. Forget putting too much data on das

Navigation systems will help orient the traveller and give him the direction he wants, heard the conference (Picture courtesy of NNG)

Is the end for dedicated, in-vehicle telematics systems now in sight? Some seemed to think so at the recent Telematics Munich 2012 conference… Geoff Hadwick reports.

Forget smartphone apps – leave that sort of thing toForget putting too much data on dashboard screens, too, because “traditional apps and mobile services are designed to turn their users into a screen zombie … they want to take up your time and keep you on that screen for as long as possible because that it what is valuable,” fellow speaker Jim Nardulli, senior vice president of NNG, added.

“Surely, in the car, the opposite is the case. We need to create things that take the cognitive load to zero” Nardulli argued, creating things that keep people’s hands on the wheel and their eyes on the road. “If we don’t do this, the legislators are going to rule us into a corner,” he warned.

ITS professionals, stressed Lanctot, need to remember that “we are not going to make money from selling apps. We are going to make money from saving lives on the road and improving the relationship between the driver and his vehicle.”

He is convinced that the next generation of in-vehicle communication systems will see the sector moving “from analytics to prognostics,” with connectivity devices moving towards “a system with embedded modems that will first and foremost provide for automatic crash notification plus vehicle diagnostics/prognostics”.

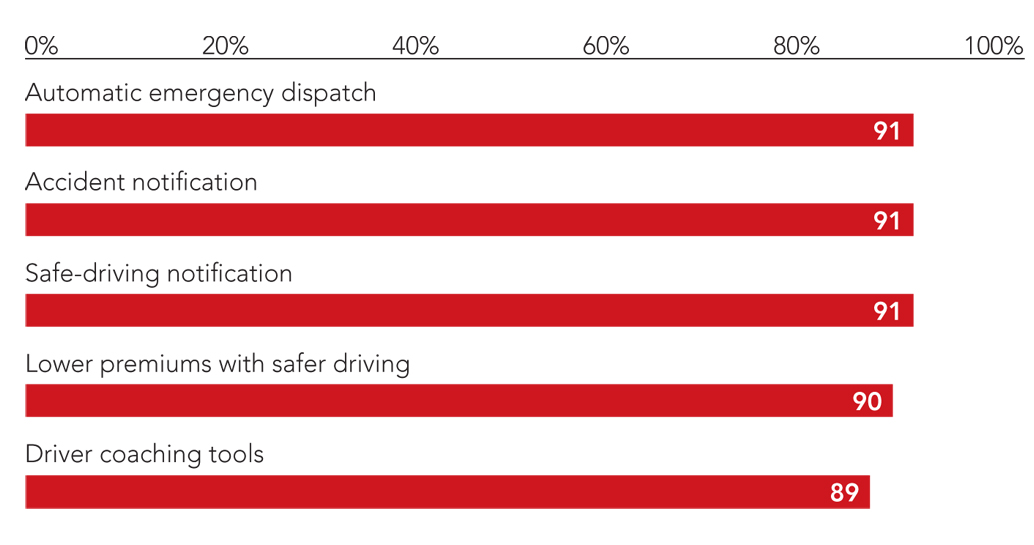

The real commercial imperative, he suggested, will be driven by an increasingly influential insurance sector demanding more and more safety and security features, allowing better drivers to reap the rewards of lower premiums.

Obsolescence awaits

Lanctot predicts that data-intensive applications, such as Wi-Fi hot-spots and mobile video, will be enabled via the customer’s phone and data plan, and that the current generation of connected telematics solutions will quickly become obsolete because they are too “reactive” and only offer the sector “limited dealer engagement; limited use of vehicle data; limited consumer access to data; and limited dealer access to data.”Systems like these will be replaced with a “telematics 2.0” generation of tools that will offer “firmware over-the-air updates, prognostics, VRM (vehicle record management), IP-based traffic data, hybrid speech recognition and streaming content”.

ADAS influence

Many future moves will be driven by government legislation and increasingly stringent insurance rules, he added. For instance, Advanced Driver Assistance Systems (ADAS) are going to be more and more important, helping drivers and travellers take into account the possibilities and limitations of other drivers and the driving environment around them.ADAS in the future will typically help drivers judge how many other road users are approaching a given intersection and at what speed, for instance; be more aware of other road users while merging and changing lanes; and even warn them about traffic signs and signals ahead. The safety and security products of the future will be clearly targeted at helping drivers react quickly, safely and securely in complex traffic situations. Research in the USA, Europe and China suggests that blind spots and night vision will be key target areas, he said.

Research from Strategy Analytics suggests ADAS deployment will grow sharply between now and 2019, continued Lanctot. It is all going to come down to collecting more and more data from the travellers themselves, sorting it and analysing it with some sort of centralised intelligence, and then feeding it back to the people and the vehicles while they are on the move, he told the conference – and ITS professionals need to think as carefully as possible about “feeding on-board sensor inputs to off-board servers to enable safe driving and traffic management solutions”.

Lanctot wants to see the emergence of “software and cloud systems that anticipate and interpret potential hazardous circumstances or impending failures.”

But exactly how the market achieves these sorts of results is neither here nor there, Nardulli of NNG told the meeting. “The technology is irrelevant, the platform is irrelevant and the system is irrelevant,” he said. “The consumer just wants it to work and really doesn’t care how.”

“They just drive along thinking ‘help me now’,” Nardulli said, “and it will be navigation systems that bring it all together. Navigation will help orient the traveller and give him the direction he wants. The future is not LTE (4G long-term evolution) or new technologies of any kind, the future lies in finding ways to merge it all together and giving consumers a better service in a simple, easy-to-use and non-distracting way. It is going to be all about creating a great user experience.

“We don’t need to do anything revolutionary,” he continued. “There isn’t going to be any kind of paradigm shift. We need to be evolutionary, face up to the fact that the telematics sector is going to be subsumed into the consumer electronics industry. We are just going to be a pipe.”

Americans drive 1,500bn miles per year, Nardulli told the conference, and spend an average of 250 hours per annum at the wheel. This is valuable time and there is “a massive opportunity” to find new ways to advertise and market products to people on the move.

Personal computers are losing out to smartphones and tablets and people will increasingly connect to the online world when they are on the move. The telematics sector needs to keep its finger in this lucrative pie. “Americans spend more time per annum sitting in their cars than they do on vacation,” Nardulli said. “Mobile advertising revenues will exceed internet advertising revenues soon; 62% of all advertising revenue on mobile is spent on search, and this is going to rise rapidly to 95%.”

This is a landscape that certainly appeals to Richard Cornish, automotive business development director at

- People’s desire to bring their personal, cloud-based social interactions, data and applications into the car, requiring more cellular connectivity

- The fact that cars are no longer a status symbol among young people, with a trend towards car sharing rather than car ownership

- Increasing environmental awareness and urbanisation

- The rapidly increasing cost of motoring, particularly in terms of fuel and insurance

- The trend towards smarter, multimodal travel patterns (car, public transport, bike, plane, train).

Cornish wants to create a sort of bond of trust, encouraging consumers to allow Vodafone to track them in return for making their journeys safer and their vehicles more secure. And, in terms of achieving mobile connectivity, there are three ways of connecting the vehicle, said Cornish. First, using an embedded SIM that is relevant to car-centric apps or cloud information.

Embedded SIMs give the best performance for safety applications like e-call and remote diagnostics and control, as well as stolen vehicle tracking, he said. A second option is tethering, using the smartphone as a modem. This is especially appropriate to cloud information, suggested Cornish. The third option is to use an aftermarket device like a dongle, which he said would allow faster deployment to market.

The way to make it work in practice, said Cornish – echoing other speakers at the conference – is to recognise that “customers desire less complexity and more integrated solutions”.

The core services envisaged by Vodafone are road charging, usage-based insurance, safety and security, vehicle diagnostics, infotainment, the mobile office, driver assistance and navigation and traffic, he said. There will be “high volumes of data that need to be collated, aggregated and analysed,” concluded Cornish, and Vodafone aims to “go beyond mobility, taking machine-to-machine further into the vehicle ecosystem”.