Eric O’Rear, Wallace Tyner and Kemal Sarica examine the far-reaching implications of replacing fuel taxes with a mileage tax.

Lawmakers at both the federal and state level are frustrated over declining fuel tax revenues as they struggle to fund projects for constructing and maintaining state-wide infrastructure. The decline stems from the fact that federal rates have not budged since 1993 and tax rates in more than two-thirds of states have not been adjusted to keep up with inflation. Other factors include the increasing fuel efficiency of new cars and small trucks or light-duty vehicles (LDVs) and an increasing number of hybrid and alternative-fuelled vehicles.

While inflation-indexing could counter some of the erosion of fuel tax revenues, a profound political distaste for tax increases has made this virtually impossible. Various US-based groups are now backing vehicle miles travelled (VMT) taxes as a replacement for fuel tax in order to create sustainable revenue streams and save governments from having to limit transportation budgets or call on funds from non-transportation taxes. VMT taxes would be applicable to vehicles using all types of fuel while maintaining the flexibility to vary rates based on energy-efficiency to incentivise higher efficiency vehicles. Mileage taxes are also believed to encourage more efficient use of roadways because motorists now have a greater incentive to drive less, carpool or use alternative modes.

Anti-tax advocates argue that concerns over implementation strategies, exorbitant administration costs and privacy issues make

VMT taxes an unrealistic alternative, while advocates view these as obstacles that can be overcome with political support and education about the benefits of mileage taxes. As governments deliberate, they must also consider potential linkages between the alternative tax approach and existing environmental policies within the transportation sector in order to get a complete picture of the overarching effects of employing a VMT tax system.

The US Department of Transportation (DoT) sets Corporate Average Fuel Economy (CAFE) Standards and the Renewable Fuels Standard (RFS) to lower the fuel demands of LDVs over time. CAFE requires automobile manufacturers to meet minimum fuel economy standards for all new vehicles and in 2011, President Obama ordered a tightening of the CAFE standards so that by 2025 the average fuel economy of LDVs will double. RFS requires a minimum volume of renewable fuels to be blended with transportation fuels to reduce crude oil demands.

The objectives of these policies overlap with some of the secondary effects associated with increases in gasoline and diesel tax rates (reduced fuel use spurred by fuel price increases and changes in driving behaviour). When debating the use of mileage-based fees to create sustainable tax revenue streams, it is important to consider the impact of switching tax regimes on overlapping CAFE, RFS and fuel tax policies.

Analysis

To better understand differences between the impact of fuel taxes and VMT taxes (and the effects of overlapping tax and environmental policies), we conducted a study utilising a version of the US Environmental Protection Agency’s MARKAL (MARket ALlocation) model and database. The study compared the existing fuel tax with the VMT tax regimes, observing differences in revenues collected, miles driven, energy use and fleet efficiency as well as the interaction between the VMT tax regime and the RFS and CAFE policies.

Three policy scenarios were modelled:

- Reference of continued gas taxes assuming tax rates increase 1% annually to account for inflation

- VMT Charge #1 where fuel taxes are replaced by a uniform mileage charge applicable to all LDVs

- VMT Charge #2 - a flat-rate, revenueneutral VMT charge that generates similar levels of revenue as the Reference scenario.

All three scenarios included the mandated increases in CAFE Standards, the RFS, and tax credits worth up to $7,500 for Plug-in Hybrid Electric Vehicles (PHEVs) purchased after 2010.

The study evaluated two policy cases. For ‘Case 1’, the Reference and VMT Charge #1 scenarios were compared to reveal the potential for additional revenue generation compared with fuel tax. For ‘Case 2’, the Reference and VMT Charge #2 scenarios were compared to reveal underlying secondary effects linked to changes in the tax system.

The two VMT rate structures modelled reflect different goals. VMT Charge #1 was developed to demonstrate how the current fuel tax structure could produce greater levels of revenue over time if implemented as a mileage-based tax structure. With VMT Charge #2 the aim was to shift the focus from revenue generation by using a revenue-neutral mileage tax regime in order to assess secondary effects such as changes in average fleet efficiency, energy use and driving behaviour associated with VMT tax implementation.

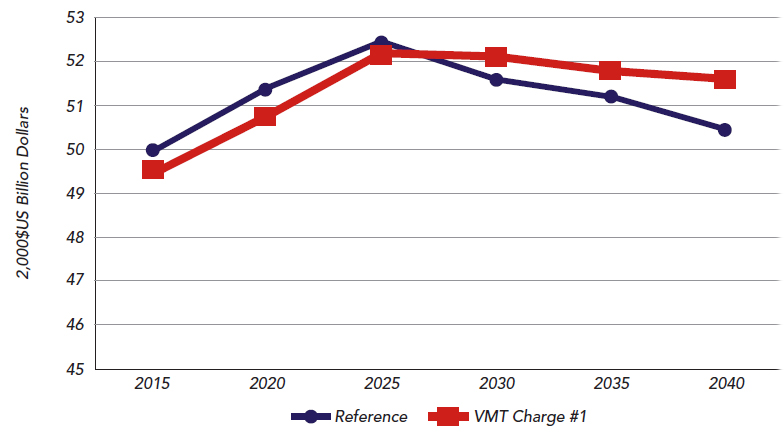

Case 1 showed that, over the longer term, mileage taxes can create more revenue than fuel taxes as considerable erosion of the Reference fuel tax revenues would occur after full adoption of the new CAFE regulations in 2025 (Figure 1). By that time, motorists would be driving more energy-efficient and alternative fuel vehicles plug-in hybrid electric vehicles (PHEVs) which escape paying fuel taxes, either partially or completely, but would pay similar levels of VMT tax (VMT Charge #1) as conventional vehicles – thereby boosting total tax revenues.

Case 2 comparisons revealed that transitioning away from fuel taxes (Reference) to a revenue-neutral VMT tax (VMT Charge #2) leads to little, if any, change in the total number of miles driven because the tax is not high enough to spur considerable changes in driving behaviour.

Additionally, revenue-neutral VMT taxes actually lower the average fuel economy of the LDV fleet whereas moderate increases in

fuel taxes lead to improvements in average fuel economy.

As a result of Revenue-neutral VMT charges lowering average LDV fuel economy, overall fuel demands by LDVs are higher – partly because fewer hybrids would be purchased in response to mileage charges.

While existing credits encourage the adoption of hybrids, mileage taxes discourage their use. This is consistent with other studies, which have found that replacing fuel taxes with VMT shifts the burden from fuel-inefficient vehicles to the more efficient ones and creates a disincentive to drive energy-efficient vehicles. This alone would run counter to the goals of federal programs (such as PHEV credits), which encourage the use of more energy-efficient vehicles.

Figure 2 shows a snapshot of the LDV fuel demands in years 2025 and 2040. While total gasoline demands (sum of E10 and E85 gasoline blends) are similar across both tax regimes in 2025 and 2040, the balance of the two blends differs across tax scenarios. With the traditional fuel tax, E85 is a heavily consumed fuel by 2040 but with VMT tax a higher proportion of E10 is consumed.

This substitution is driven by the absence of fuel taxes under the VMT tax regime. Removing the energy taxes lowers the prices for the two fuels and consumers respond by demanding more of both fuels. Given that these fuels are ethanol-blends, the higher demand will raises ethanol prices. Since E85 comprises around 85% ethanol, it will be significantly costlier than E10, which is 10% ethanol.

Both tax scenarios see an increase in electricity demand as a result of greater PHEV use but by 2040 demand will be slightly lower under the VMT system as VMT taxes discourage the ownership of hybrids. Secondly, the removal of fuel taxes makes gasoline more price competitive with electricity, so hybrid drivers will use more gasoline (rather than electricity) to power their vehicles.

A revenue-neutral VMT tax has considerable impact on the demand for renewable fuels. Figure 3 shows the different alternative renewable fuels (bio-gasoline, bio-diesel, corn ethanol and cellulosic ethanol - fuel types used to meet RFS requirements) consumed by LDVs in 2025 and 2040. With the existing fuel tax, cellulosic ethanol will be the second-most consumed renewable fuel with a five-fold increase in demand between 2025 and 2040. Under a VMT tax regime, by 2040 cellulosic ethanol is completely driven out while demand for the others increases.

This is because of the interaction of VMT taxes with the RFS and what energy experts refer to as the ‘blend wall’. The blend wall is the maximum amount of ethanol that can be sold each year given a series of market conditions that limit how much can be blended with conventional motor fuels.

Our analysis reveals that not only do mileage fees have the potential to generate more sustainable streams of revenue over time, but depending on the level of stringency they can also cause changes in energy use and the types of crude-based fuels consumed.

Realistically, VMT pricing schemes are unlikely to use flat-rate charges as considered in the study and will employ a tier-based system of varying tax rates based on vehicle fuel economy, or weight and roadway damage potential, or environmental impact. Whatever VMT pricing scheme is considered, a detailed examination of how it would impact existing transportation policies must be conducted to get a full picture of benefits and costs.