All over the world, governments, transportation agencies and local authorities are casting around for new forms of revenue as the money from taxes imposed on fuel begins to trickle away. Spending is outstripping tax take as a combination of more efficient internal combustion engines and the increasing take-up of cars with alternative drivetrains, such as hybrids, steadily erode the cash base.

Ageing infrastructure does not help and, in the US alone, there is an estimated $1.1 trillion gap between what’s needed and what’s a vailable to be collected. Federal government requires states to prioritise keeping freeways and larger highways in good condition – but that takes money.

The problem is no less acute in Hawaii. In terms of adoption of electric vehicles (EVs), Hawaii is in the top three states in the US, while sales of vehicles offering a high miles-per-gallon figure are also strong: the fuel economy of all new cars sold in Hawaii outpaces the national average. While environmentally good, this obviously creates a revenue problem.

“Fuel tax revenue is flattening,” says Scot Uruda, federal program engineer at

Specific problems

To stem the leakage of fuel tax cash, HDoT has already considered gas tax hikes, registration fee increases, EV fees, distance-based charges and rental car surcharges.

Hawaii also has its own specific problems which are not shared by most states. It is a series of islands, with a belt road system which is susceptible to shoreline erosion. For Hawaii’s policymakers, climate change is not an abstract problem: rising sea levels have the potential to cause havoc on the archipelago and this is a major concern. Hawaii is also uniquely isolated: it imports 90% of its beef, more than two-thirds of its produce – and exactly 100% of its petroleum. That makes it the most fossil fuel-dependent state in the US, which goes some way to explaining why it is the first to adopt a 100% clean energy goal by 2045. It also has a number of active volcanoes whose eruptions can cause transit disruption and, as Uruda put it in a recent presentation, “hurricanes and storms seem to like us!”

It is a time for serious thinking, which is why HDoT is now looking at something else as a revenue-neutral replacement for the gas tax: road user charging. Following a feasibility study in 2016, HDoT secured a Surface Transportation System Funding Alternatives grant of nearly $4m to test road user fee concepts in a demonstration project. The idea was to try out a state-wide road usage charge “not only as a potential successor to state fuel taxes but also as a potential platform for collecting federal fuel taxes, county fuel taxes, and other state and county user-based fees such as registration and weight fees”, Uruda says.

To do that it needs to engage with legislators, stakeholders and motorists to gather feedback that informs policy recommendations on whether and how to enact such a charge. With that in mind, in August last year it launched the Hawaii Road Usage Charge (HiRUC) Demonstration project.

At present, assuming an average 22 miles per gallon, Hawaii residents pay around $80 fuel tax each year. “If a driver has a more fuel-efficient car, he’d pay less fuel tax,” says Uruda. “If he drives a gas guzzler, he’d pay more.”

Questions to answer

There are a number of questions to answer, Uruda points out, not least about how a new way of collecting revenue might nudge people towards different ways of operating – and whether there will be unintended consequences for certain groups in society. “Will a mileage tax affect decision-making and behaviour? Also, are we unfairly penalising rural and long-distance drivers? Will it cause additional hardship?”

“Fairness is a concern that’s been raised,” explains Uruda. “There is a clean energy policy statewide. Owners of clean vehicles are concerned that all of a sudden they will be paying a tax that they don’t right now.”

In fact, the new tax would replace the existing one – not run alongside it. “It’s a one-for-one replacement,” says Uruda. “The per-gallon tax goes away and the mileage-based user charge comes in.”

At present, HDoT picks up $83m per year in fuel tax. It remains to be seen whether this will be matched – or what extra costs might be involved. “We want to collect the same amount,” insists Uruda. “We realise that the cost of collection may differ. The fuel tax has been around a long time; a different method and systems will most likely be more expensive.” For instance, he says, the DoT may need to collect $85m in order to net that $83m. “When we do this study we’ll get some sense of the collection fees.”

The fact that there is an existing infrastructure already in place should help. Hawaii collects mileage data during annual vehicle inspections, which means a future transition to road usage charges should mean no extra work for drivers and less cost to the state. For the time being, vehicle owners in Hawaii submit to an annual inspection and safety check, where odometer readings and other data are noted. “We can calculate how far the driver has travelled and can calculate miles per gallon,” says Uruda.

“As people are renewing their safety check, we’ll mail driving reports to owners and show how much fuel tax they would pay, based on the odometer reading,” says Uruda.

They will then be invited to the second phase (the ‘automated’ demonstration) which will involve volunteer participants state-wide being offered automated means of measuring distance travelled, and receiving road usage reports – containing road user charging and vehicle driving details based on that data. These collection methods could range from GPS-based systems to taking smartphone pictures of odometer readings (see Technology requirements).

Offering choices

“We’re trying to offer choices,” says Uruda. “We will generate mock invoices and try to get feedback from them,” Uruda says. He is looking forward to the practical side of the programme. “It’s interesting because of the volume. It’ll be a close approximation to the real thing and we’re hoping to get some really good data.”

The live operational demonstration of part two will last nine months and will involve up to 2,200 vehicles, all of which are registered in the state of Hawaii.

Between March and May this year, HDoT held 13 meetings across the state to discuss state roadway funding, the road usage charge and the demonstration project. Focus groups have been helpful in determining how HDoT should go about the process. It was important to raise awareness of the problem, allowing residents to understand that transportation funding will decline. Clarifying key points would also be helpful, with residents likely to be less resistant to a road usage charge when they know it is a replacement for the state gas tax and the average driver would probably pay $80 annually. The fairness of the charge, that anyone who uses roads, including visitors and large trucks, must contribute to road funding, is also important. Residents know that the state already collects mileage data at the annual safety checks, so that was a non-issue for them. Summarising the key points in a mailer, including a personalised comparison of the annual state gas tax versus the proposed new road usage charge, helped to make the change more meaningful.

Hawaii’s four main counties (Hawaii, Honolulu, Kauai and Maui) are also distinct islands which assess a gas tax at a specific rate. Movement of vehicles between the islands is rare, but during HiRUC it is likely that one or more of them will illustrate a county road usage charge rate which is separate from the state one, for miles driven in that county.

As it stands, money from the gas tax comes to the highways division and is dedicated to state roadways, paying for routine maintenance. “With the road user charge, the intention is the same,” says Uruda. “The DoT is looking at a fair way to get revenue that is sustainable and reliable.”

The current system

At present, Hawaii requires all vehicles to undergo periodic inspections as a condition of registering the vehicle. New vehicles must receive an inspection within two years of purchase, with all other vehicles inspected annually. These inspections include visual examination of vehicle safety features, testing of lights, brakes and recording the odometer reading. Several hundred licensed inspectors are located throughout the Pacific archipelago. Using a private contractor, HDoT equips each inspector with an iPad to input data about each vehicle inspected, including the odometer reading.

Policy areas

There are a variety of issues which need examination in HiRUC – for instance, how to enforce compliance with reporting and payment, what impact the payment frequency choices would have on public acceptance and how the legislature will determine rates.

EV ownership has been promoted by the state leadership and the state-wide initiative to be energy-independent in the next 25 years or so is firmly in place. So there is also the question of how per-mile charging might complement environmental policies the state is considering such as a carbon tax – and what impact the new charge would have on how much people drive.

Uruda says: “We recognise we have to look at everything as a whole, including how it crosses other policy areas. When we write the full report to the legislature we’ll see how the road usage charge would work.” That report will be submitted in 2021.

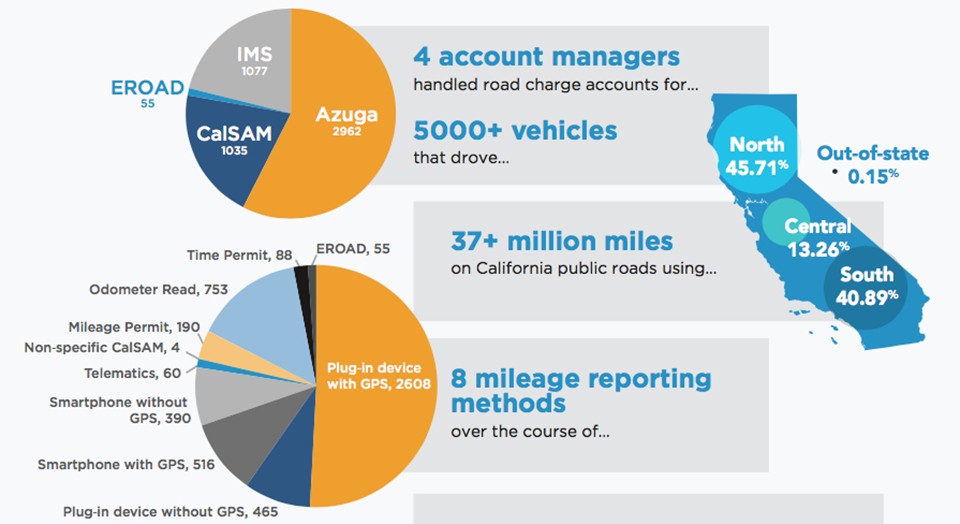

D’Artagnan Consulting is responsible for procuring one private sector entity or consortium to assume the role of account manager for the HiRUC demonstration. “When we’re doing the automated part they will design the system to help oversee the operation,” explains Uruda. While the procurement process was ongoing as ITS International went to press, that part of the equation should now be in clear focus.

Whichever way you cut it, a road usage charge would represent quite a change. But nothing is set in stone, and the final decision on which route to take lies with elected politicians. “This is not a done deal,” concludes Uruda. “It will come down to what the state legislature decides to do.”

Technology requirements

Participants in HiRUC’s live automated demonstration will choose from among the following mileage reporting options:

1. OBDII plug-in device with GPS

The device fits into the vehicle’s on-board diagnostic port (OBDII), available on all US cars manufactured since 1996 (except the Tesla 3). This will support automated reporting of miles driven by location (GPS).

1a. OBDII plug-in device without GPS

This fits into the vehicle’s OBDII but does not contain a GPS chipset, calculating distance by integrating the vehicle’s speed signal or following the actual odometer.

2. Native automaker telematics

These are computer systems embedded in vehicles by the manufacturer that can communicate with external carmaker computer systems and use this connection to provide a range of services to drivers. Road usage charging would be an application running on a native telematics platform.

3. Smartphone odometer image capture

Also called odometer charge, this would use a mobile phone camera to capture and send an image of the odometer periodically. It would use MVerity software either as a feature embedded in the vendor’s own app (for both iOS and Android), or will use the MVerity On Demand system, by which participants receive a text message with a link to odometer image capture software.

Source: D’Artagnan Consulting