The increasing availability and accuracy of global navigation satellite system (GNSS) is opening up low-cost options in many areas as David Crawford finds out.

Boosting commercialisation of European global navigation satellite system (EGNSS) technologies for ITS initially depends heavily on demonstrating competitive and cost/benefit advantages obtainable from the deployment of EGNOS (the current European Geostationary Navigation Overlay Service), and ultimately the EU’s Galileo constellation (see box). So, between January 2015 and December 2016, the EC co-funded Joint EUropean Project for International ITS/EGNSS awareness Raising (JUPITER) is backing a series of profile-raising initiatives.

It has focused on applications developed by or for small- and medium-sized enterprises (SMEs) and public authorities. Ten of the 25 projects chosen for support have now carried out partial cost-benefit analyses of their work to a level that JUPITER deems to be exploitable. The process used a methodology specially developed by project partners, among them French consultancy Capital High Tech, whose Anne Le Calvé reported progress at the ITS European Congress in Glasgow, UK in June 2016.

The research survey required participants to offer for comparison, non-EGNSS-based alternatives to their solutions. Unlike conventional cost-benefit analysis (CBA), JUPITER has not converted the assessed benefits into formal monetary values because, Le Calvé told ITS International, “the solutions developed were not mature enough for such complete evaluation. They were at the end of their development stage, had yet to be implemented in the field, or had not been operative for long enough to generate sufficient data on their impact.”

Three initiatives were highlighted in the Congress presentation, one of which centres on the South Moravian integrated public transport system covering Brno, the Czech Republic’s second largest city, and its surrounding area where the operator, Kordis, serves a population of some 1.2 million. In trying to encourage greater use of non-car travel, it had been facing problems over the reliability of the service connections being relayed to passengers, using information based on an existing GPS-based bus tracking system.

Kordis therefore budgeted €2.2 million (US$2.42 million) for replacement EGNSS-based on-board equipment, in a bid to make its information more accurate and less subject to the signal disruptions characteristic of urban areas. The unit cost was similar to the existing products installed in 2005.

This upgrade is immediately expected to save the €25,500 (US$28,050) annual cost of a full-time employee needed for the ‘manual’ management of the previous system. Kordis sees the costs of dismantling and recycling the old units as relatively insignificant, and calculates the potential time saving for passengers at 4,000 hours per day.

Both the two other cases involve SMEs. One, set up by academic staff at a European university, has focused on the importance of having more precise vehicle location available in road safety applications ranging from advanced driver assistance and collision avoidance systems to the automatic guidance of connected vehicles.

The solution it has developed uses an intelligent data-based fusion of GPS and EGNOS positioning, geographic information systems, environmental data and output from in-vehicle dynamic sensors. This resulted in upgrading the vehicle positioning accuracy from the previous metre level to one measured in decimetres, with an updating frequency rising from the typical 5Hz up to 100Hz – using low-cost equipment.

Currently the price for both collision avoidance and automatic guidance applications is between €2,500 and €3,000 (US$2,750 and US$3,300) per unit but is expected to fall to around €1,000 (US$1,100) once in mass production. The developers see the key benefits as being access for carmakers to affordable, as well as more accurate, equipment, and increased safety for drivers.

The other SME, a relatively young spin-off from another European university, has explored new solutions based on geodesy and geomatics techniques for high-precision positioning. Its initial product aims to address the growing problem of maintaining Europe’s ageing and deteriorating road bridges to acceptable levels within limited financial resources, by using permanent and continuous condition monitoring.

At present, bridge and highway operators do not routinely use GNSS receivers for this kind of monitoring because the cost is typically more than €10,000 (US$11,000) per unit. They rely instead on topographic surveys carried out by technicians at, for example, three-monthly intervals, or a combination of strain gauges, inclinometers and linear positions sensors. The new solution, the cost of which the developer believes could be as low as €2,000 (US$2,200), aims to deliver high-precision (millimetre-level) positioning by combining new, consumer-grade, single-frequency GNSS receivers with positioning data elaboration algorithms. This system will detect the slightest movement of the bridge be that due to weather effects, heavy loads or earth tremors and could enable tracking of gradual movements such as settlement while monitoring for structural deterioration.

The company believes its expertise in analysing GNSS observations will allow it to fine-tune these algorithms to fit the specific characteristics of the receivers. It is aiming to fill the gap resulting from the fact that most current low-cost GNSS units are typically embedded in vehicle-based and mobile devices and are not available on the general market.

A year-long run up period has seen pilot tests on structures other than bridges – for example, high-voltage electricity transmission towers and high-rise buildings – to avoid disrupting traffic. Trial monitoring at genuine locations was due to be under way by mid-2016.

The company has recently set up a partnership with a commercial consortium to design and develop the hardware needed to house its data processing and computation capabilities. It is now approaching highway and bridge operators across Europe (with some early interest), the US and Japan. It also believes that the principle can be applicable to other built structures, such as those that it has used in the trials.

Galileo set for lift-off

Initial services from Europe’s civilian-controlled Galileo constellation are expected to become available by end-2016, with full-scale deployment of the 24-satellite constellation scheduled for 2020. A precursor, EGNOS (European Geostationary Navigation Overlay Service), the first continent-wide initiative in the field of satellite location and navigation, has emerged in the short term to enhance the accuracy of existing signals in supporting safety-critical transport applications.

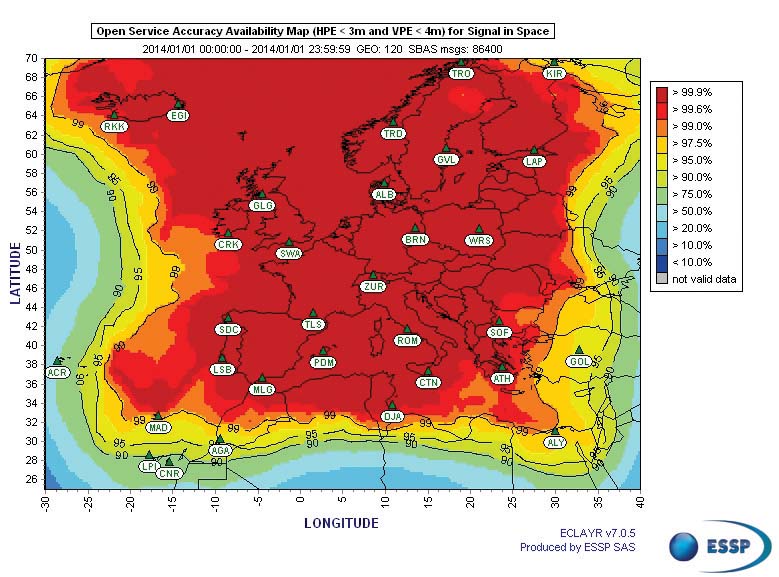

It has, for example, successfully augmented output from the US GPS satellite navigation system, to make this more reliable in use, by sending out a signal containing information on the reliability and accuracy of the GPS signals. EGNOS has enabled users to confirm their location to an accuracy within 1.5m. The term EGNSS is used to cover both EGNOS and Galileo. Development is on the basis of compatibility with both GPS and Russia’s GLONASS array.

- David Crawford has spent 20 years writing about and researching ITS and is a Contributing Editor to ITS International.